"A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs."

"Madrigal Pharmaceuticals Inc. ( NASDAQ: MDGL) recently received European Commission approval for its MASH treatment, and the share price surged. While a couple of officers sold some shares, one director stepped up to boost a stake to more than 1.9 million shares. The stock is up 45.4% in the past month and is trading near an all-time high of $433.94. The share price is 63.6% higher than a year ago, far outperforming the S&P 500."

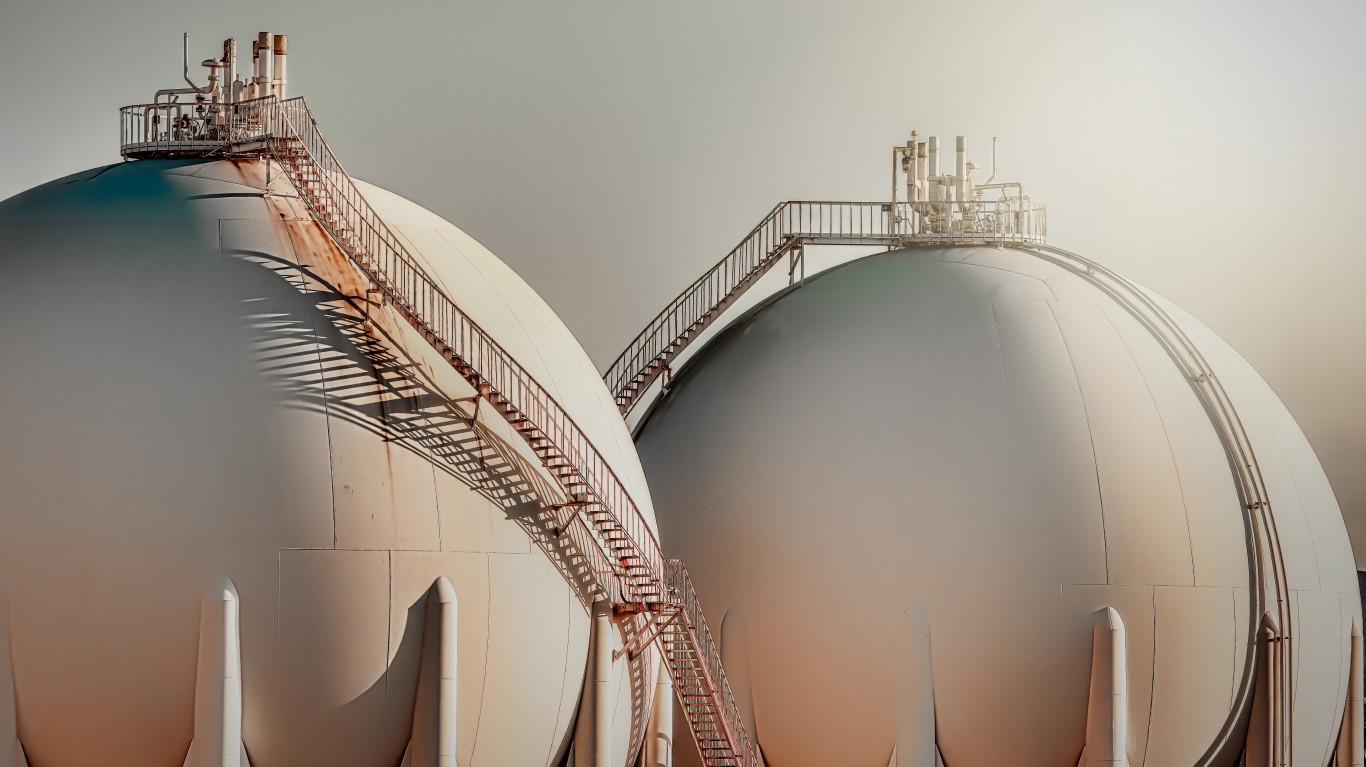

A director significantly increased a stake in Madrigal Pharmaceuticals to more than 1.9 million shares after European Commission approval for its MASH treatment, driving the stock sharply higher. Madrigal shares are up 45.4% over the past month, trade near an all-time high of $433.94, and sit 63.6% above last year’s level. Analysts show a consensus price target of $461.43 and a consensus recommendation to buy, implying roughly 8.7% upside. Other notable insider buys included a large purchase of a natural gas pipeline company by a former CEO and a return buyer boosting an industrial products stake. Insider buying is presented as a potential positive signal, though some insiders remain restricted from trading during the earnings season.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]