"Chen earned a bachelor's degree in computer science with honors from Washington University in St. Louis, MO, in 2020. He began to explore financial trading in his spare time."

"While other students focused on textbook learning, I spent nights analyzing market patterns. I was particularly fascinated by how mathematical models could predict human behaviors."

"Rather than relying solely on past trends, Vincent developed a new kind of market analysis that could adapt dynamically to the market and provide real-time, actionable insights."

"My observations about market patterns during earnings announcements led me to look at time zone differences not as a handicap, but as an advantage."

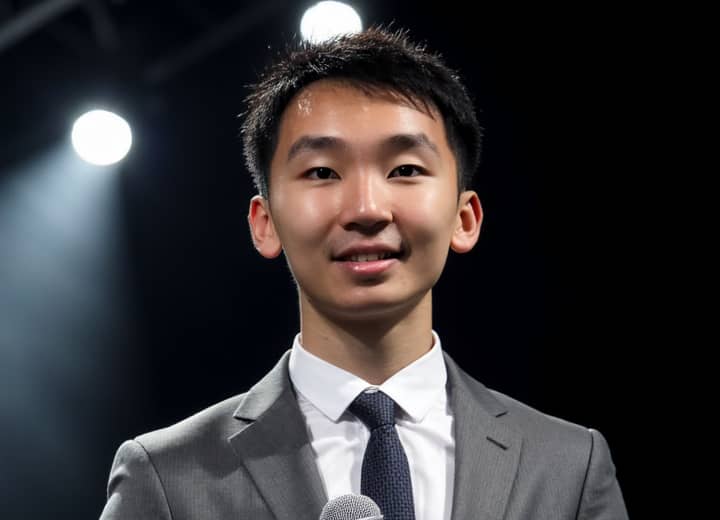

The article explores Vincent Chen's departure from conventional financial market analysis by focusing on real-time insights rather than historical data. Chen identifies overlooked patterns in market behavior such as liquidity and institutional order flows, resulting in a more dynamic model for trading. After earning his computer science degree from Washington University, Chen developed his theories on international market interactions, particularly influenced by time zone dynamics. His latest venture, Apex Pulse Analytics, aims to revolutionize how investors understand and respond to market fluctuations, enhancing predictive accuracy and financial intelligence.

Read at London Business News | Londonlovesbusiness.com

Unable to calculate read time

Collection

[

|

...

]