"A natural person or persons, who end up owning or controlling a legal entity, is what is termed as the ultimate beneficial owner. One of the most efficient measures to make sure that the businesses are dealing with the right people is to define UBOs. Companies with complicated corporate structures are used to conceal the identity of fraudsters and money launderers. In the absence of proper UBO checks, there is a risk of facilitating illegal dealings, terrorism funding or other financial offenses of a business."

"This increased level of scrutiny complicates the ability of bad actors who can use legitimate financial systems. UBO Checking as a Compliance Requirement As part of their know your customer (KYC) and customer due diligence (CDD) procedures, regulatory authorities in several jurisdictions are obliging financial institutions and other obligated entities to conduct UBO checks. These are the checks that are intended to confirm both the ownership organization of the clients and that the information given is accurate and up to date."

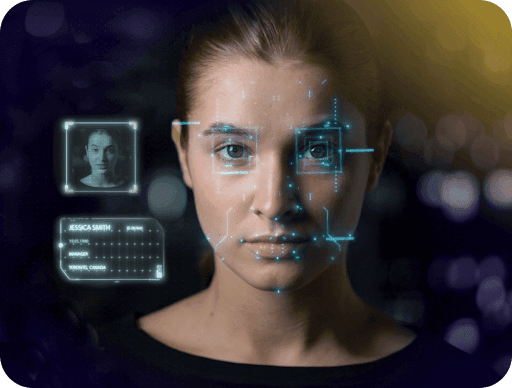

Ultimate beneficial owners are the natural persons who ultimately own or control legal entities, and identifying them reveals concealed risks and prevents misuse of corporate structures. UBO identification strengthens KYC and CDD by exposing owners hidden behind shell companies and nominee directors, reducing opportunities for money laundering, terrorism financing, and other financial crimes. Regulatory frameworks increasingly require UBO verification as part of AML compliance, obliging institutions to confirm ownership and keep information accurate and current. Robust UBO checks serve both regulatory compliance and risk management, fostering transparent business relationships and protecting firms and financial systems from illicit activity.

Read at Socpub

Unable to calculate read time

Collection

[

|

...

]