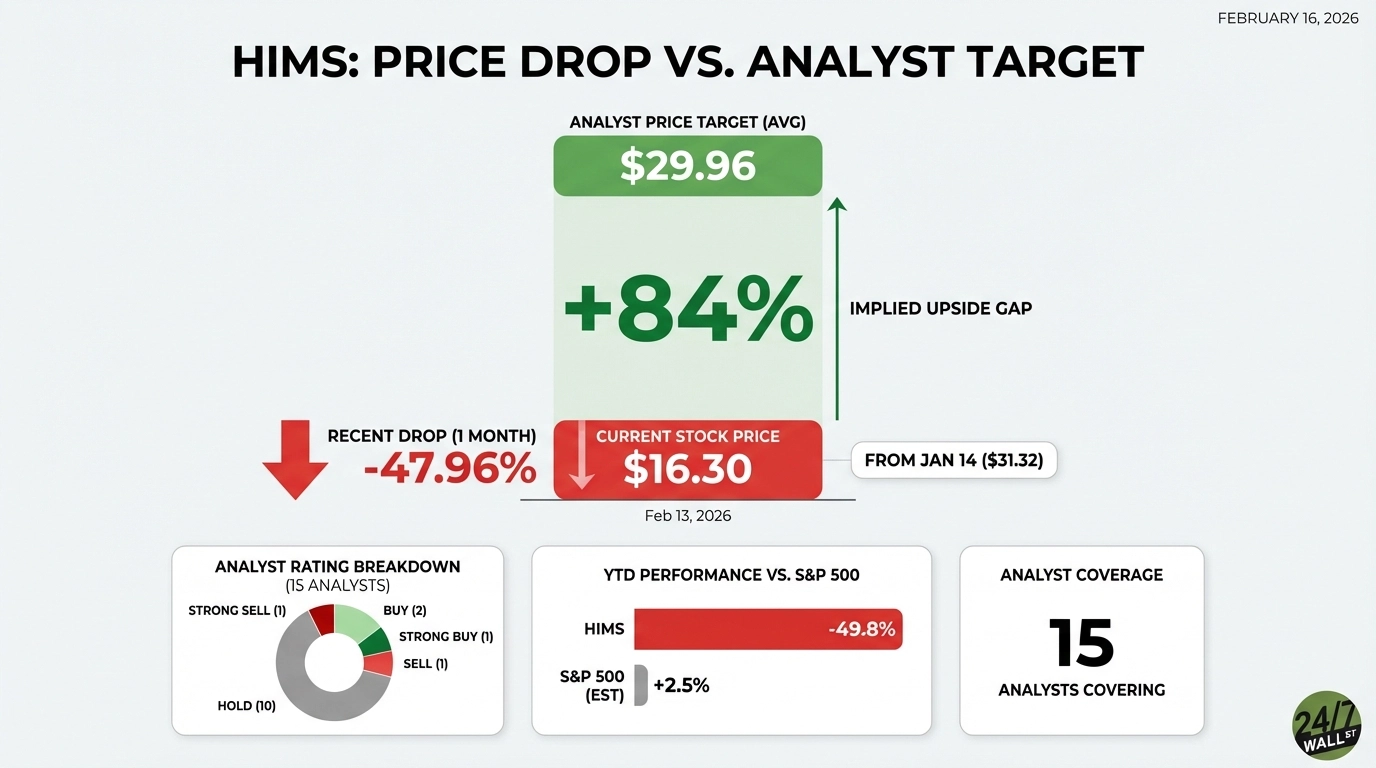

"Hims & Hers Health ( NYSE:HIMS) has crashed 47.96% over the past month, falling from $31.32 on January 14 to $16.30 as of February 13. Yet Wall Street analysts still see the telehealth platform reaching an average price target of $29.96, implying 84% upside from current levels. The disconnect raises a critical question about whether this represents a buying opportunity or a value trap."

"The collapse began February 7 when the FDA announced action against Hims' $49 compounded weight-loss pill, citing concerns over quality, safety, and federal law violations. Shares fell 14.1% in after-hours trading. The pain intensified February 9-10 when Novo Nordisk ( NYSE:NVO) sued Hims for patent infringement over compounded semaglutide, forcing the company to cancel its newly launched Wegovy alternative."

"Hims had strategically positioned itself in the booming GLP-1 weight loss market, targeting patients who couldn't afford or access branded alternatives like Wegovy. The regulatory crackdown and lawsuit strike at the core of that growth strategy. Reddit sentiment turned sharply bearish, with the dominant post on r/wallstreetbets attracting 1,306 upvotes and 236 comments discussing the FDA restrictions."

Hims & Hers Health shares fell 47.96% from $31.32 to $16.30 between January 14 and February 13. The decline accelerated after February 7 when the FDA announced action against Hims' $49 compounded weight-loss pill, citing quality, safety, and federal law concerns. Novo Nordisk sued Hims for patent infringement over compounded semaglutide, prompting cancellation of Hims' Wegovy alternative. Hims targeted the GLP-1 weight-loss market with lower-cost options for patients. Fifteen analysts average a $29.96 price target, citing subscriber growth, revenue beats, and potential expansion into new specialties as upside drivers.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]