"Abbott's medical device segment grew 14.8% to $5.45 billion. The cardiovascular portfolio drove results, with TriClip for tricuspid valve repair gaining Japan approval and Navitor TAVI expanding its CE Mark in Europe. Diabetes Care also contributed meaningfully. Abbott met EPS estimates at $1.30. Diagnostics fell 6.6% as COVID testing revenue disappeared. Operating income rose 13.1% to $2.06 billion, though net income stayed flat year over year."

"Lilly's revenue hit $17.60 billion, beating estimates by 9.5%, with Mounjaro generating $6.52 billion (up 109%) and Zepbound adding $3.57 billion (up 184%). Volume across the incretin portfolio surged 62%. Net income jumped 475% to $5.58 billion. Operating margin reached 48.3%, nearly double Abbott's. CEO David Ricks highlighted progress on orforglipron, an oral GLP-1 candidate that completed four Phase 3 trials and could enable global obesity submissions by year end."

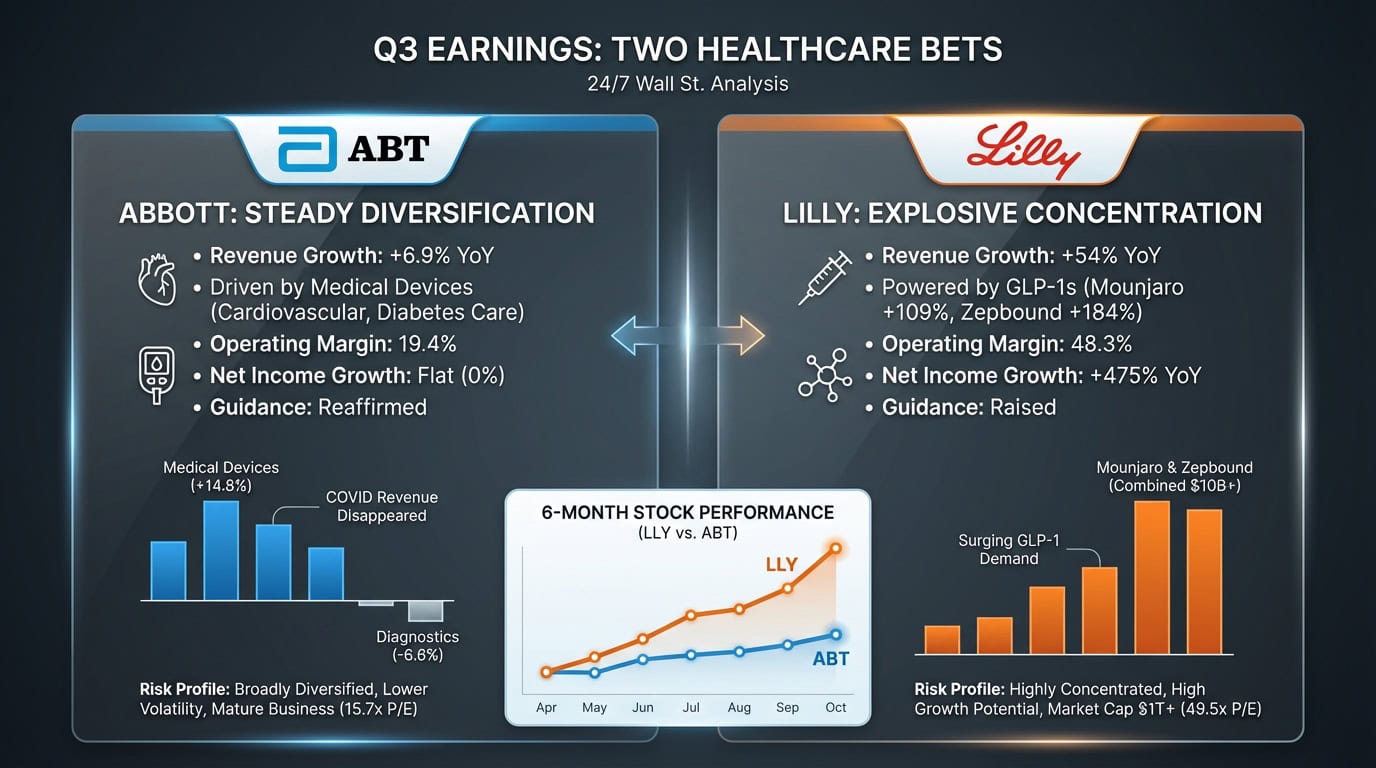

Abbott reported 6.9% Q3 revenue growth with medical devices up 14.8% to $5.45 billion, propelled by its cardiovascular portfolio including TriClip and Navitor TAVI. Diagnostics fell 6.6% as COVID testing revenue disappeared; operating income rose 13.1% to $2.06 billion and EPS met estimates at $1.30. Lilly posted 54% revenue growth to $17.60 billion, driven by Mounjaro ($6.52 billion) and Zepbound ($3.57 billion), with incretin volume up 62%. Net income jumped 475% to $5.58 billion and operating margin reached 48.3%; Lilly raised full-year guidance and advanced oral GLP-1 candidate orforglipron through Phase 3. Abbott reaffirmed 7.5-8.0% organic growth outlook excluding COVID testing.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]