"Big banks across the world are substantially increasing their financing of the fossil fuel industry, including for the industry's expansion during a time of intensifying climate crisis, all while pulling back from previously stated climate commitments. These are among the key highlights of the most recent Banking on Climate Chaos report, which found that the 65 biggest banks globally committed a whopping $869 billion to companies conducting business in fossil fuels in 2024, representing a huge $162 billion increase from 2023."

"Banking on Climate Chaos, co-authored by several organizations including Rainforest Action Network, Oil Change International, Indigenous Environmental Network, and Sierra Club, is an authoritative annual study - endorsed by hundreds of organizations across the world - of how banks finance the fossil fuel industry. The report also shows that U.S. banks like JPMorgan Chase, Bank of America, Citigroup and Wells Fargo dominated the heights of fossil fuel financing."

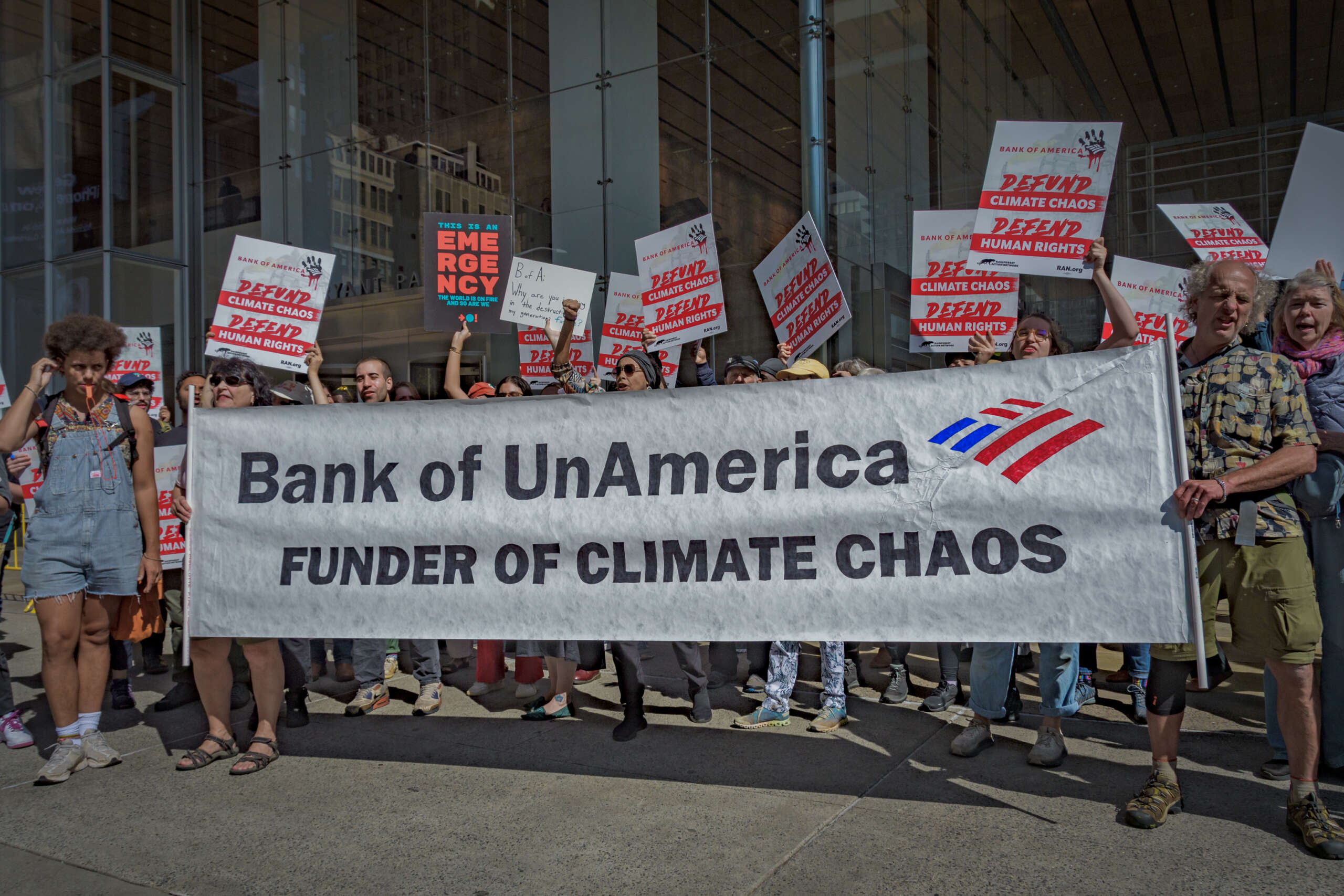

Climate activists rallied outside the Bank of America Tower in Midtown Manhattan during a march to end fossil fuels. Sixty-five largest global banks committed $869 billion to companies conducting fossil fuel business in 2024, a $162 billion increase from 2023. Banks are increasing financing for fossil fuel industry expansion even as climate impacts intensify and many are retreating from prior climate commitments in favor of short-term profits. Major U.S. banks including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo led fossil fuel financing. CEOs of the top six U.S. banks earned over half a billion dollars from 2022 to 2024, far exceeding incomes of most-impacted communities. Organizations named include Rainforest Action Network, Oil Change International, Indigenous Environmental Network, and Sierra Club.

Read at Truthout

Unable to calculate read time

Collection

[

|

...

]