"Across more than 220 global markets, Airbnb primarily relies on card-based payments for bookings. To reduce checkout friction, improve accessibility, and increase adoption in international markets, Airbnb introduced trusted, locally preferred payment methods(LPM) as part of its "Pay as a Local" initiative. The effort enables guests to choose payment options that align with regional preferences while allowing engineering teams to scale support for new methods more efficiently."

"As part of the Payments long-term architecture initiative, Airbnb moved from a monolithic system to a domain-oriented services architecture. Core domains cover pay-ins, payouts, transaction fulfillment, processing, wallets, incentives, issuing, and settlement. The processing subdomain integrates with third-party PSPs via a connector and plugin framework, supporting API and file-based integrations, reducing effort and accelerating onboarding across markets. Supported LPMs include country or region-specific digital wallets (M-Pesa, MTN MoMo), online bank transfers (Online Banking Czech, Online Banking Slovakia),"

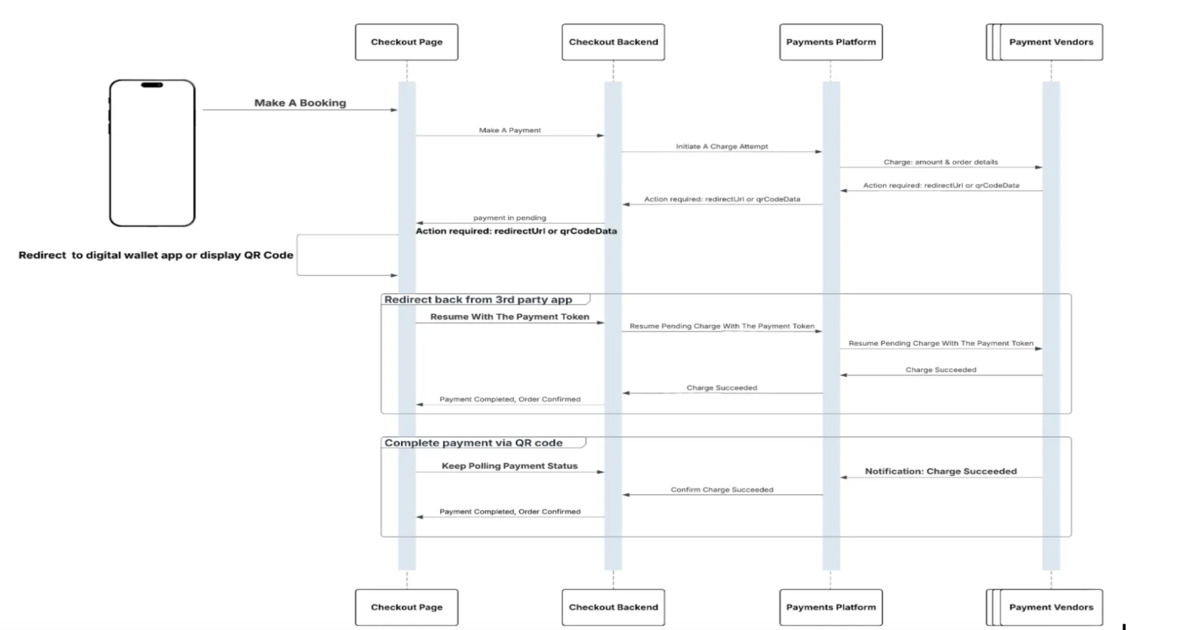

"Airbnb analyzed the behaviors of 20+ global LPMs and identified three foundational payment flow archetypes: redirect, asynchronous, and direct. Redirect flows send guests to a third-party app or website to complete a payment and return a confirmation token. Asynchronous flows, such as QR-based payments, notify Airbnb via webhooks after the transaction completes externally. Direct flows allow guests to enter credentials within Airbnb's interface for immediate processing. Standardizing these flows into reusable archetypes reduced engineering effort and simplified the onboarding of additional provi"

Airbnb operates across more than 220 global markets and primarily relies on card-based payments for bookings. The Pay as a Local initiative introduced trusted, locally preferred payment methods (LPM) to reduce checkout friction, improve accessibility, and increase adoption in international markets. Payments moved from a monolithic system to a domain-oriented services architecture with core domains for pay-ins, payouts, transaction fulfillment, processing, wallets, incentives, issuing, and settlement. The processing subdomain integrates with third-party PSPs through a connector and plugin framework supporting API and file-based integrations. Supported LPMs include M-Pesa, MTN MoMo, Online Banking Czech and Slovakia, Pix, UPI, EFTPOS, and Cartes Bancaires. Engineers analyzed 20+ LPMs and standardized redirect, asynchronous, and direct payment flow archetypes to reduce engineering effort and simplify provider onboarding.

Read at InfoQ

Unable to calculate read time

Collection

[

|

...

]