"A clear record of your wins, losses, and thought process separates impulsive guesses from intentional growth and trading discipline."

"Trading journal templates are pre-designed formats that you can use to log your trades in an organized and systematic fashion."

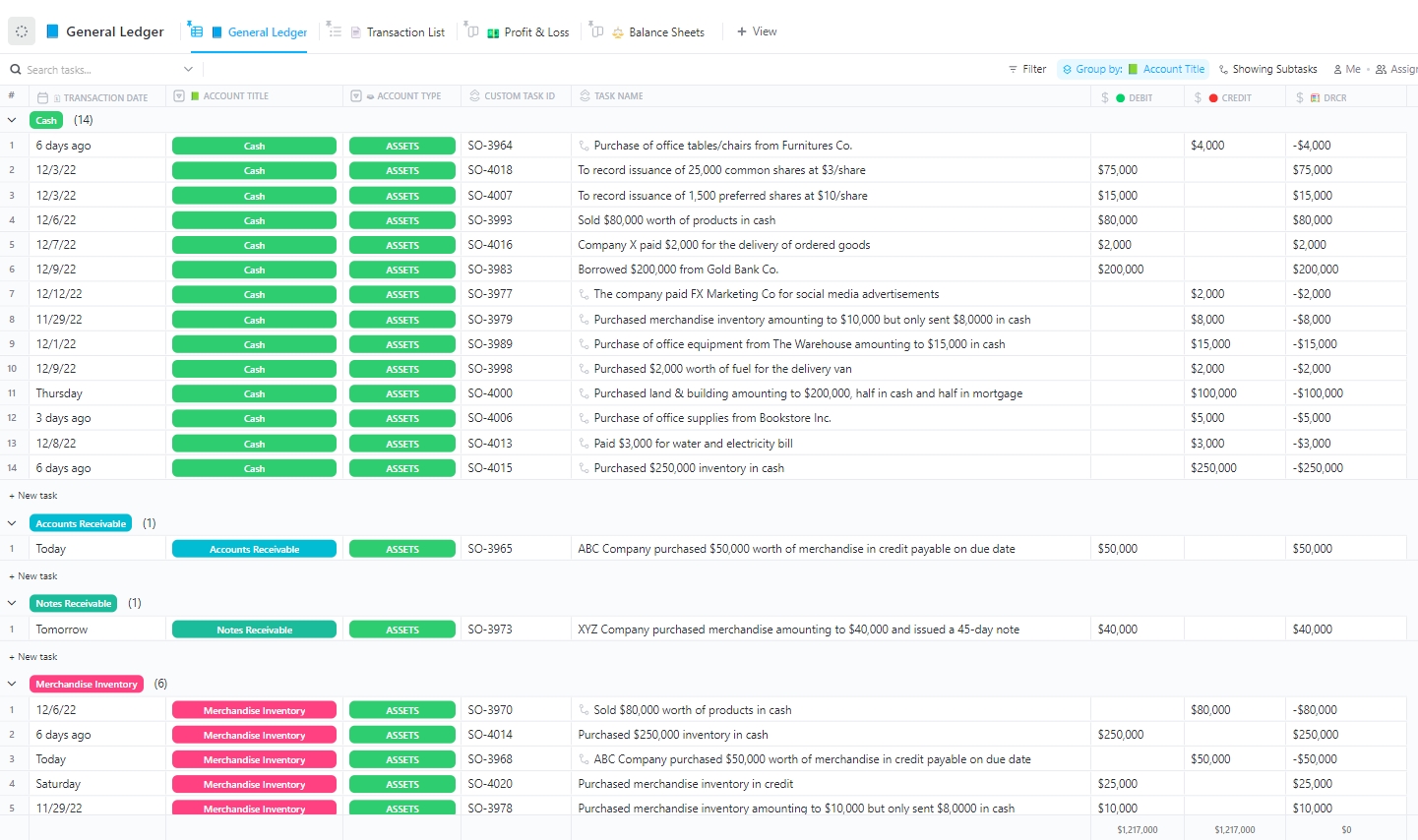

Maintaining a detailed record of trades is crucial for traders to differentiate between impulsive decisions and intentional strategies. A well-structured trading journal template enables traders to log trades systematically, assisting in identifying successful strategies and recognizing emotional influences on decision-making. The templates often include essential data fields such as entry and exit prices and provide space for personal reflections, ultimately leading to improved trading practices. Insights from structured tracking can reveal significant patterns and enhance long-term trading performance.

Read at ClickUp

Unable to calculate read time

Collection

[

|

...

]