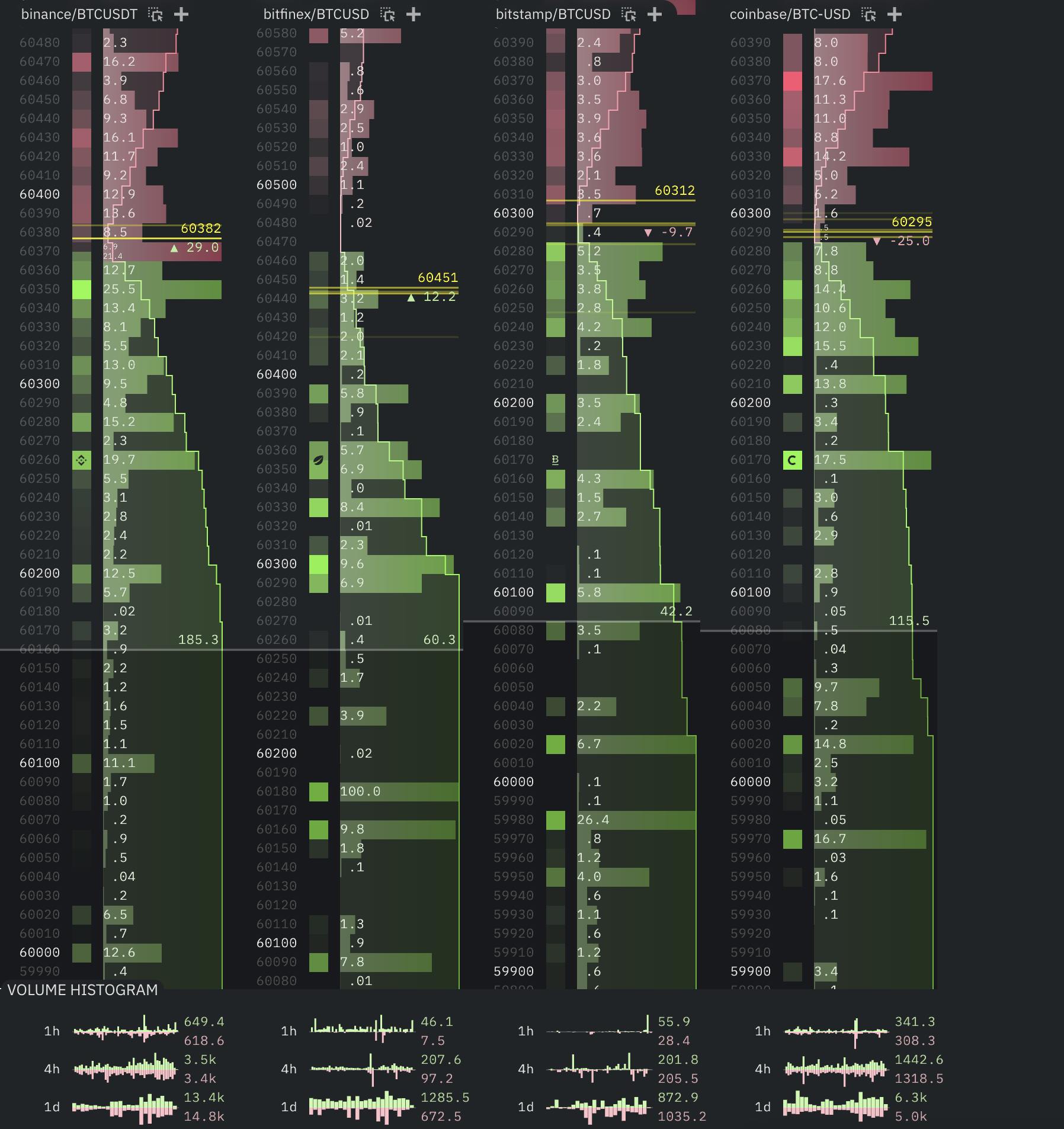

"One of the main advantages of trading cryptocurrency derivatives is data transparency; seeing the full market depth for all products is standard."

"Even if they manage to understand how to read the order book, they more often than not fall for spoofing and end up on the completely wrong side of the trade."

"The order book, sometimes also called the market depth or DOM, shows us the resting limit orders, also known as passive orderflow."

"As someone who originally came to trade crypto from a legacy markets background, I always viewed the order book information as noise due to a large amount of spoofing."

This article explores the importance of order books in cryptocurrency trading, highlighting their transparency in contrast to traditional markets. In crypto, traders can access complete market depth, which shows resting limit orders and liquidity. However, this data can overwhelm traders, particularly due to the prevalence of spoofing, where false orders distort the order book. Understanding how to read and utilize these order books effectively is essential for successful trading in crypto markets, providing insights into market behavior not visible in legacy trading systems.

Read at Hackernoon

Unable to calculate read time

Collection

[

|

...

]