"Wells Fargo & Co., JPMorgan Chase & Co., U.S. Bancorp and Citigroup Inc. will streamline requests for an additional 90-day forbearance period, allowing borrowers to apply verbally without paperwork, Newsom said on a press release Tuesday. Bank of America Corp. announced in November that it will offer qualifying borrowers up to two additional years of forbearance. Most lenders limit forbearance to 12 months under a California law that expanded an emergency agreement the state had reached with banks in January 2025."

"Last year, the Intercontinental Exchange Inc. estimated that there was $11 billion in outstanding mortgage debt in the path of the fires. Newsom, a termed out governor who's considering a presidential run, has faced renewed criticism from the White House and other political adversaries for his handling of the catastrophic wildfires, which tore through large swaths of Southern California last year and killed at least 31 people."

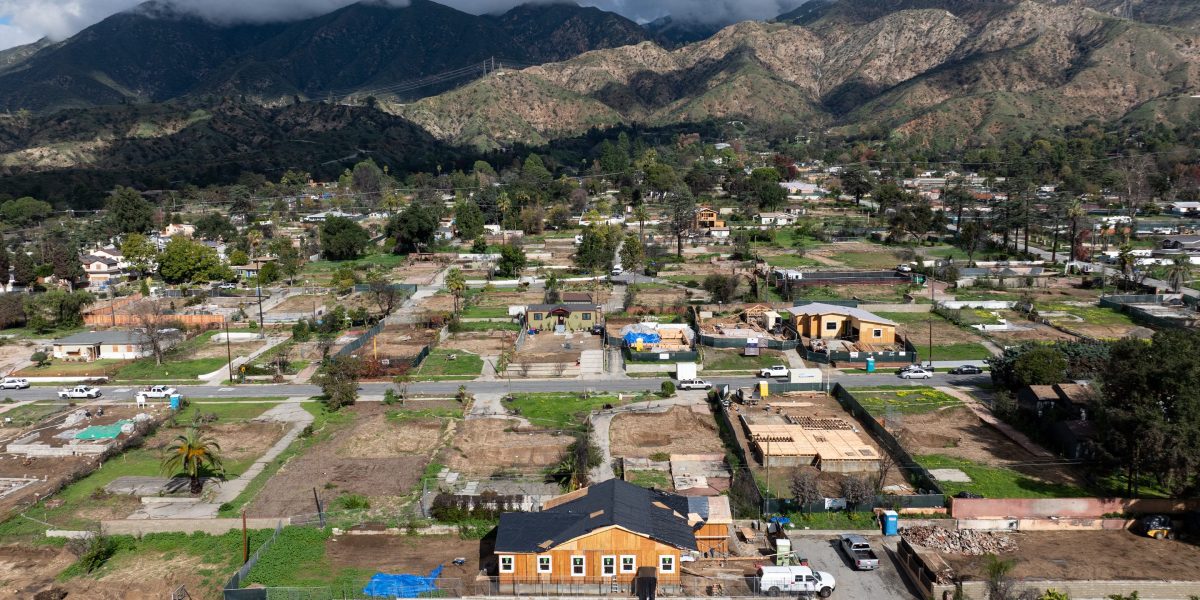

Major banks agreed to extend mortgage relief for Los Angeles wildfire victims by streamlining requests for an additional 90-day forbearance period and allowing verbal applications without paperwork. Bank of America will offer qualifying borrowers up to two additional years of forbearance. Most lenders generally limit forbearance to 12 months under a California law that expanded an emergency agreement in January 2025. An estimated $11 billion in mortgage debt was in the fires' path. The governor will pursue a financing fund to close insurance shortfalls, expand CalAssist eligibility, and the state has paid $5.98 million to 732 households.

Read at Fortune

Unable to calculate read time

Collection

[

|

...

]