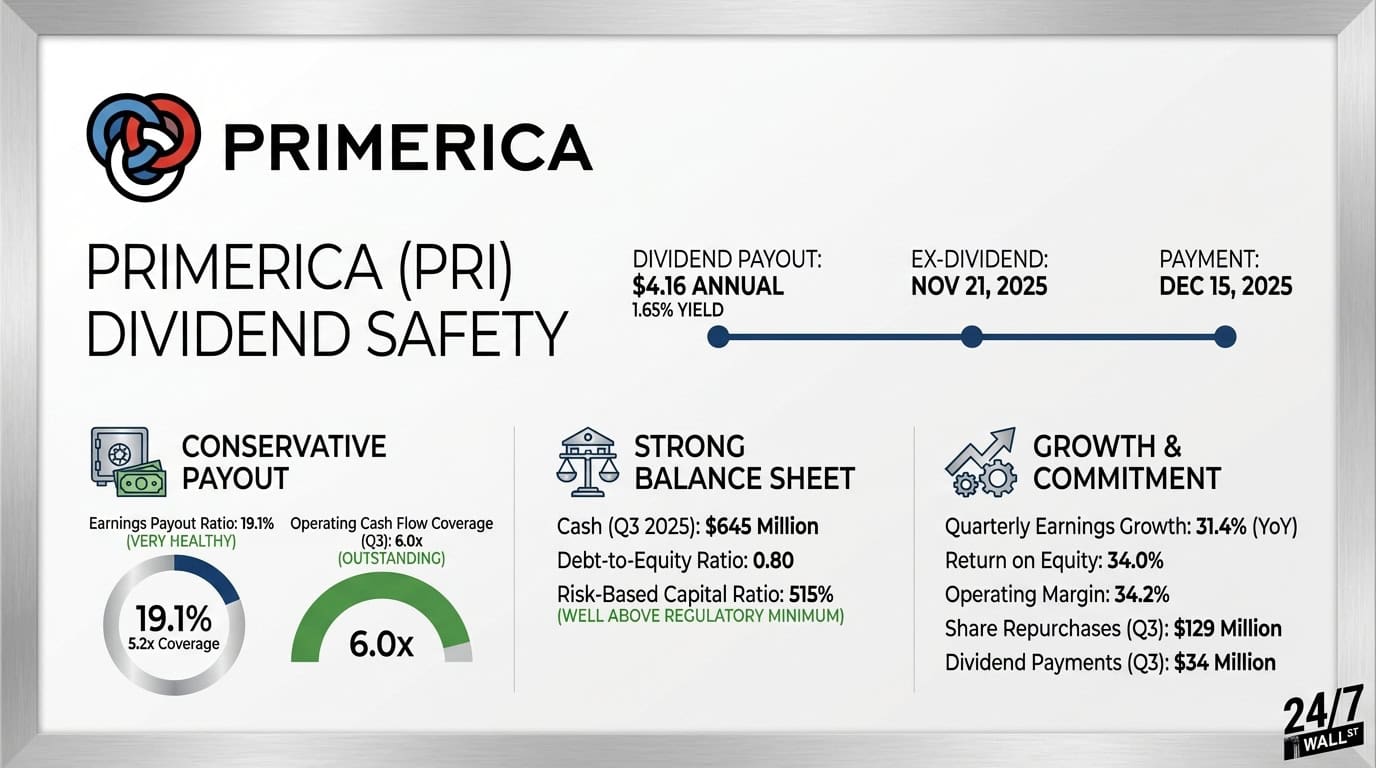

"Primerica ( NYSE: PRI) pays a $4.16 annual dividend with a 1.65% yield. Based on current financial metrics, we examine whether this financial services provider can sustain this payout. Current Coverage Metrics Show Conservative Payout Primerica's current payout ratios are remarkably conservative. The company earned $21.77 per share over the trailing twelve months while paying $4.16 in dividends, producing an earnings payout ratio of just 19.1%. Current earnings cover the payout 5.2 times over."

"The free cash flow picture is even stronger. In Q3 2025, Primerica generated $202.9 million in operating cash flow and spent only $12.3 million on capital expenditures, leaving $190.6 million in free cash flow for the quarter. Against quarterly dividend payments of $33.8 million, operating cash flow coverage stands at 6.0 times. Balance Sheet Supports Growth Primerica ended Q3 2025 with $645 million in cash and a debt-to-equity ratio of 0.80. The company's insurance subsidiary maintains a risk-based capital ratio of 515%."

Primerica pays a $4.16 annual dividend yielding 1.65% while earning $21.77 per share over the trailing twelve months, producing a 19.1% earnings payout and 5.2x coverage. Q3 2025 operating cash flow was $202.9 million with $12.3 million in capex, leaving $190.6 million free cash flow and 6.0x coverage against quarterly dividends. Primerica held $645 million in cash and a 0.80 debt-to-equity ratio, with its insurance subsidiary reporting a 515% risk-based capital ratio. Q3 revenue rose 8.1% to $839.8 million and earnings increased 31.4% to $206.8 million. Management returned $163 million to shareholders via buybacks and dividends.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]