"York Water ( Nasdaq: YORW) declared a quarterly dividend of $0.228 per share in November 2025, marking a 4.0% increase from the prior year and extending a payment streak that stretches back over a decade. The annual dividend now stands at $0.89 per share, yielding 2.63%. For income investors evaluating this 209-year-old regulated water utility, the central question is whether the dividend can withstand mounting capital demands and rising debt service costs."

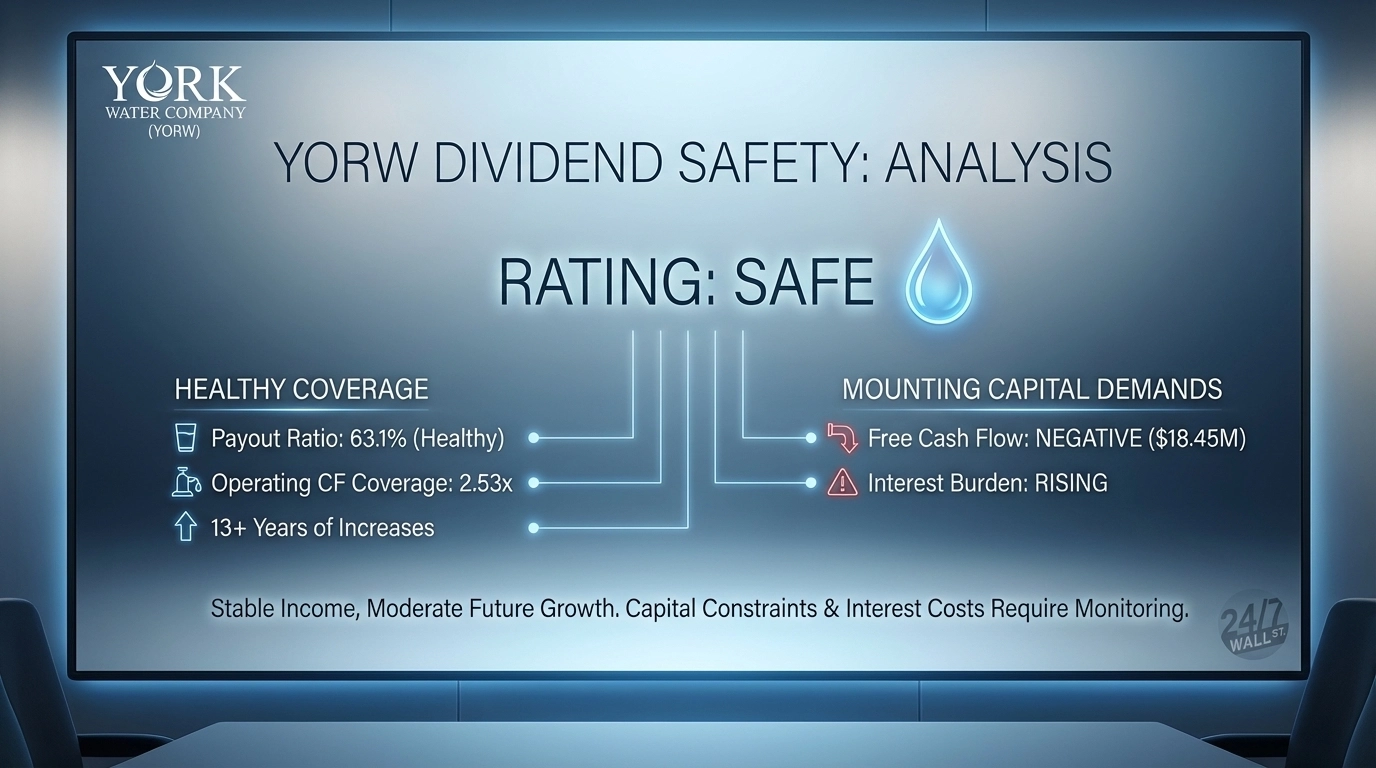

"York Water paid $12.09 million in dividends during 2024 against net income of $20.33 million, producing an earnings payout ratio of 59.5%. Based on trailing twelve-month EPS of $1.39, the current payout ratio sits at 63.1%. Both figures remain well below the 70% threshold that typically signals stress. Operating cash flow generated $30.56 million during 2024 while paying $12.09 million in dividends, delivering 2.53x coverage. This coverage ratio has remained stable between 2.0x and 2.8x over the past five years."

"Total debt reached $227.32 million as of Q3 2025, producing a debt-to-equity ratio of 0.95. Interest expense surged 74% over the past three years, climbing from $5.11 million in 2022 to $8.90 million in 2024. Interest now consumes 43.8% of operating income, up from 20.9% in 2022. This rising burden reflects both increased borrowing and higher rates. With EBITDA of $42.50 million, net debt-to-EBITDA sits around 5.3x, elevated for a utility but manageable given the regulated business model."

York Water increased its quarterly dividend to $0.228 per share in November 2025, lifting the annual payout to $0.89 and a 2.63% yield. Dividend payments totaled $12.09 million in 2024 against $20.33 million net income, yielding a 59.5% earnings payout and a trailing payout of 63.1%. Operating cash flow of $30.56 million provided roughly 2.53x coverage for dividends, but capital expenditures of $49.01 million generated negative free cash flow of $18.45 million. Total debt reached $227.32 million, interest expense rose 74% over three years, and net debt-to-EBITDA is about 5.3x.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]