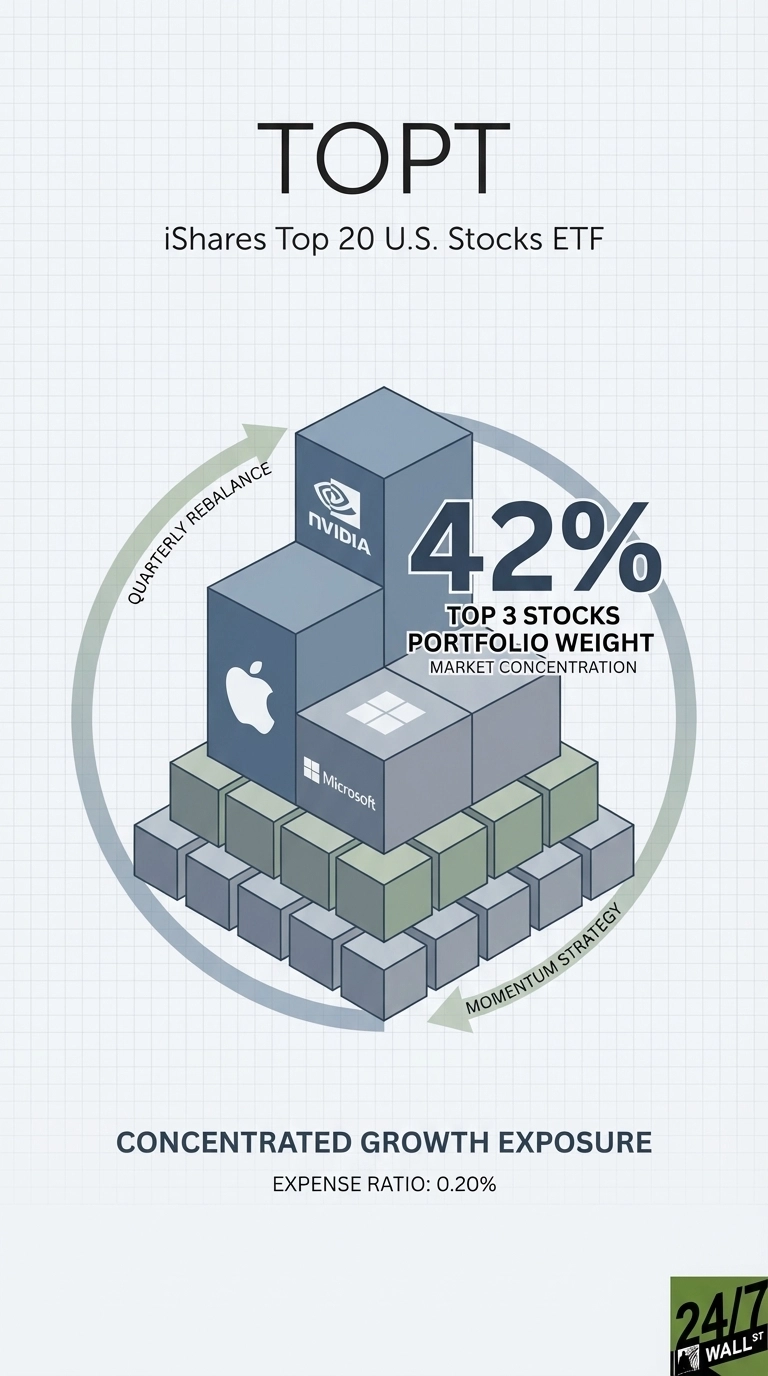

"Market concentration has reached levels not seen in decades. The three largest U.S. stocks now represent over 20% of the S&P 500's total value, and the top 20 account for roughly half. iShares Top 20 U.S. Stocks ETF ( NYSEARCA:TOPT) offers a direct bet that this 'winners keep winning' trend will continue. The Portfolio Role: Concentrated Megacap Exposure TOPT tracks the S&P 500 Top 20 Select Index, holding the 20 largest U.S. companies by market cap. The index rebalances quarterly, automatically rotating holdings to reflect which companies remain in the top tier. This creates a momentum-adjacent strategy where recent winners that grow into the top 20 get added, while those that fall out get removed."

"As of December 2025, NVIDIA Corporation ( NASDAQ:NVDA) represents 15.2% of the portfolio, Apple Inc ( NASDAQ:AAPL) 14.5%, and Microsoft Corporation ( NASDAQ:MSFT) 12.5%. Those three stocks alone comprise 42% of the fund. The 0.20% expense ratio is competitive for a concentrated strategy. With $441 million in assets under management since launching in October 2024, TOPT remains relatively small but has attracted investors seeking simplified exposure to market leaders."

"Since inception in late October 2024, TOPT has returned approximately 24%, pretty impressive for a fund that both launched near market highs, and was by design betting on the biggest winners thus far. One Reddit user in the r/investing community asked whether TOPT was "worth putting some disposable cash into," noting it " seeks to expand from the M7 to the top 20 stocks.""

Market concentration has risen to multi-decade highs, with the three largest U.S. stocks representing over 20% of the S&P 500 and the top 20 roughly half. iShares Top 20 U.S. Stocks ETF (NYSEARCA:TOPT) tracks the S&P 500 Top 20 Select Index and holds the 20 largest U.S. companies by market capitalization. The index rebalances quarterly, rotating recent winners into the fund and removing those that fall out, creating a momentum-adjacent, concentrated megacap exposure. As of December 2025, NVIDIA is 15.2%, Apple 14.5%, Microsoft 12.5% (42% combined). Expense ratio 0.20%, $441 million AUM since October 2024, and approximately 24% return since inception. Concentration risk is the primary tradeoff.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]