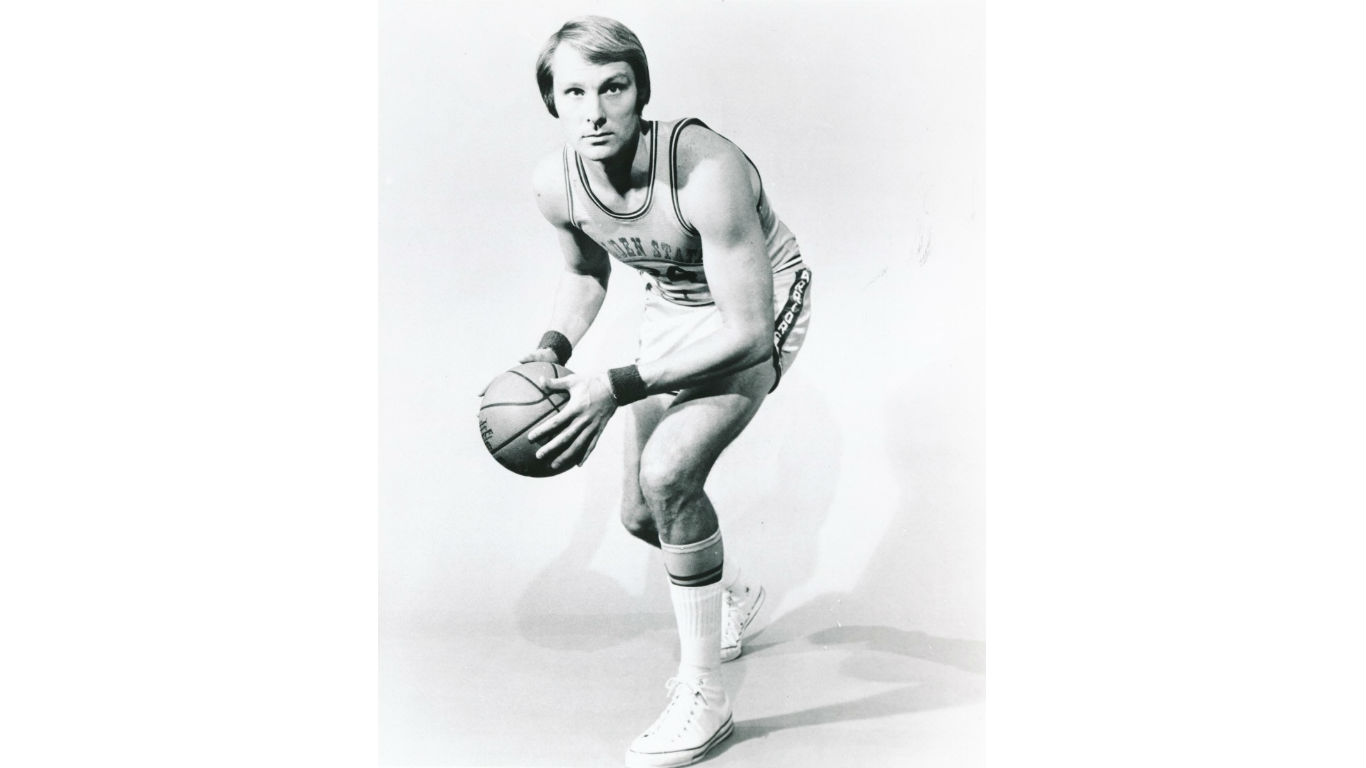

"While Stephen Curry (91.1%) and Steve Nash (90.4%) are synonymous with lifetime NBA free-throw marksmanship, 70s Hall of Famer Rick Barry stands apart - not only because he also played in the ABA and pioneered the concept of the point forward position, but because he notched a lifetime free throw percentage of 89.9% using the underhanded "granny shot" - ridiculed despite its effectiveness most recently displayed in the Netflix sports sitcom Running Point, starring Kate Hudson."

"Fundstrat's Tom Lee, a pioneering financial analyst who was the first on Wall Street to follow Bitcoin, launched GRNY, a large cap ETF 9 months ago that has since wowed rivals and investors alike with superlative gains. The fund's portfolio composition is actively managed, and reflects Lee's quarter century history as a Wall Street equities analyst. Results and reactions have been so overwhelmingly positive that Fundstrat has registered for adding two (2) more ETFs in less than a year of their initial GTNY ETF launch."

GRNY, the Fundstrat Granny Shots US Large Cap ETF, launched in November 2024 as an actively managed large-cap equity fund and has produced strong year-to-date performance of roughly +18%, outpacing much of the market. The fund’s portfolio reflects Tom Lee’s more than 25 years as a Wall Street equities analyst and relies on unconventional but disciplined approaches, analogous to the underhanded “granny shot” free-throw technique. Positive investor reaction and performance have led Fundstrat to register two more ETFs within a year of the GRNY launch, signaling rapid product expansion.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]