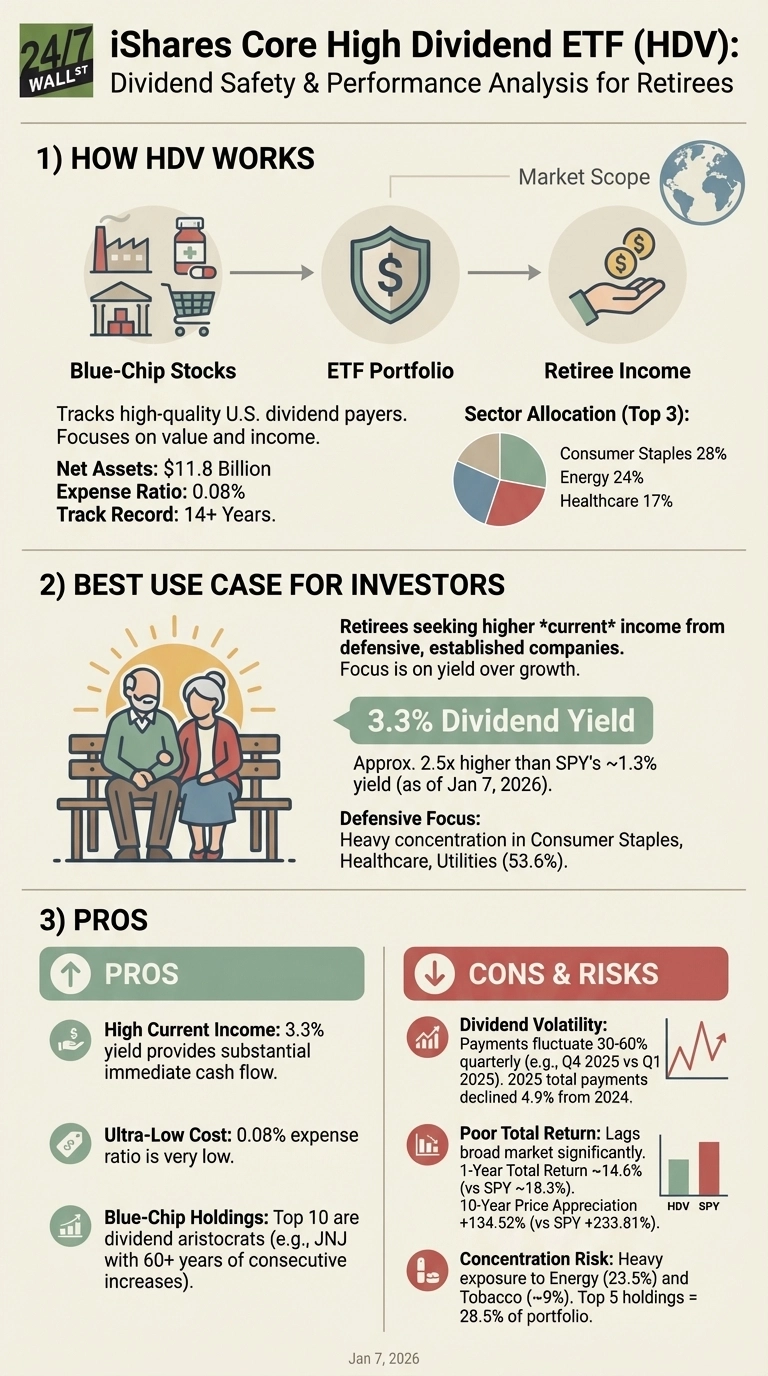

"The iShares Core High Dividend ETF (NYSEARCA:HDV) offers retirees a 3.3% yield with 0.08% fees, tracking high-quality U.S. dividend payers. The fund generates income from dividends of blue-chip stocks concentrated in Consumer Staples (28%), Energy (24%), and Healthcare (17%). With $11.8 billion in assets and a 14-year track record, HDV appeals to income-focused investors. However, distributions fluctuate significantly and have declined recently, raising sustainability questions."

"The company raised its dividend 4.9% in early 2025, continuing a 38-year growth streak, yet quarterly earnings declined 27% year-over-year. Combined with Exxon, these positions create 16.2% energy sector concentration risk. Johnson & Johnson (NYSE:JNJ), representing 6.7% of HDV, exemplifies dividend aristocrat quality with over 60 consecutive years of increases and a 49% payout ratio. The healthcare giant raised its quarterly dividend 4.8% in 2025 to $1.30 per share, maintaining its 2.5% yield with a 27% profit margin."

HDV yields 3.3% with a 0.08% expense ratio and holds $11.8 billion in assets with a 14-year track record. Income derives from dividends of blue-chip U.S. stocks concentrated in Consumer Staples (28%), Energy (24%), and Healthcare (17%). The top five holdings make up 28.5% of assets, producing concentration and dividend-safety considerations. Exxon shows a 58% earnings payout ratio and apparent dividend sustainability; Chevron carries a 95% payout ratio with recent earnings weakness. Johnson & Johnson reflects durable payout metrics, while AbbVie reports a payout exceeding 497% and an 89% plunge in quarterly earnings. Distributions have fluctuated and declined recently, raising sustainability concerns.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]