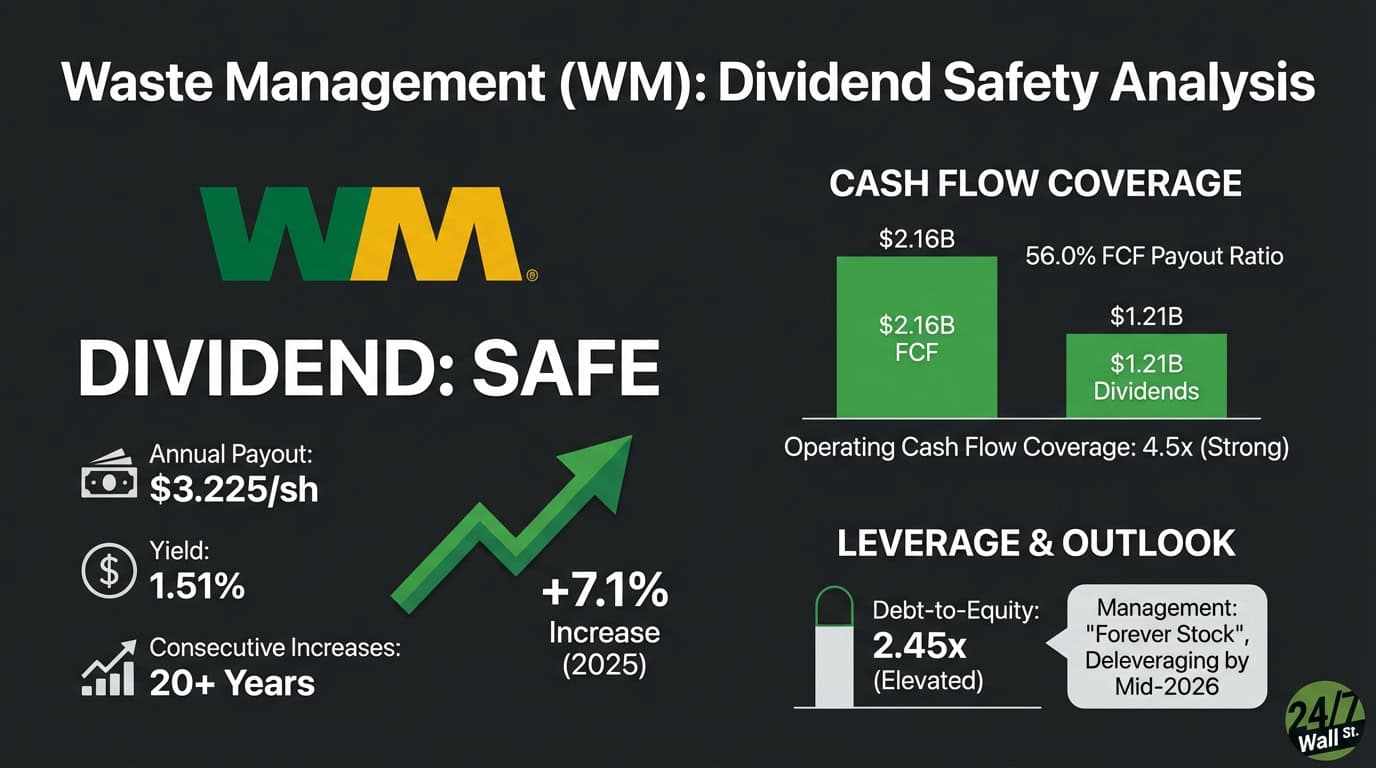

"Waste Management paid $1.21 billion in dividends against $2.16 billion in free cash flow during 2024, producing a 56.0% FCF payout ratio. That leaves nearly $950 million in retained cash after dividends. The trailing earnings payout ratio sits at 50.9% ($3.225 divided by $6.34 EPS). Over eight years, the FCF payout ratio averaged 49.4%, ranging from 39.8% in 2021 to 62.3% in 2023. Operating cash flow surged 69% from $3.18 billion in 2017 to $5.39 billion in 2024."

"Net debt-to-EBITDA stands at 3.19x, within reasonable bounds for a capital-intensive business. Interest coverage of 4.4x provides adequate cushion. CFO Devina Rankin stated in the Q2 2025 earnings call: "Our leverage ratio [...] was 3.5x. We remain focused on quickly getting back to targeted leverage levels [...] and we currently project we will achieve our target in the first half of 2026.""

Waste Management pays an annual dividend of $3.225 per share, yielding 1.51%, and increased the payout by 7.1% in 2025. The company has raised its dividend for over 20 consecutive years and the five-year dividend CAGR is 5.3%. Free cash flow of $2.16 billion in 2024 funded $1.21 billion in dividends, producing a 56.0% FCF payout ratio and leaving about $950 million retained. Trailing earnings payout ratio was 50.9% and operating cash flow rose 69% from 2017 to 2024. Total debt is $23.36 billion, net debt-to-EBITDA is 3.19x, and interest coverage is 4.4x. Management expects to return to target leverage in the first half of 2026.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]