"Perhaps as a foretaste of seasonal volatility stocks fell Friday as US tech - specifically chipmakers - wobbled, with the Nasdaq down more than 1% for the session. Nvidia was down more than 3% to extend its weakness in the wake of earnings. This seemed to weigh on Asian equities on Monday, but Hong Kong rallied 2% on a huge surge in Alibaba shares, which jumped 15% on its AI revenue growth."

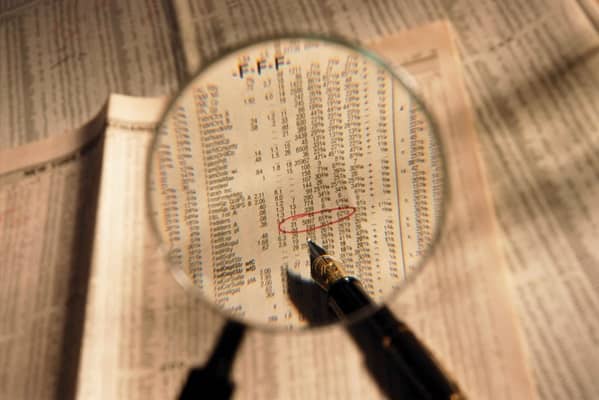

"Nevertheless, the S&P 500 notched its fourth winning month in a row in August and notched a series of record highs before the slip-up on Friday - which may have been a case of investors taking some chips off the table ahead of a long weekend in the US for the Labor Day holiday. Here's our look at the best and worst investment themes last month."

"European equity markets had a good run too and trade broadly higher this morning. French shares are stabilising after last week's drop on political worries - the government is almost bound to fall for the third time in a year when a confidence vote is held a week today. For political chaos read economic weakness. The euro doesn't mind at all and is showing strength above 1.17 against the dollar on broad greenback weakness."

September has historically been the weakest month for the S&P 500, Dow Jones and Nasdaq, and seasonal volatility contributed to a Friday sell-off led by US tech chipmakers. Nvidia fell over 3% after earnings, weighing on Asian equities before Alibaba surged 15% on AI-related revenue growth and announced a new AI chip project. The S&P 500 recorded a fourth consecutive winning month in August and a run of record highs before profit-taking ahead of the US Labor Day holiday. European equities gained broadly, French political instability threatens economic weakness, the euro strengthened above 1.17 and the FTSE 100 posted modest gains.

Read at London Business News | Londonlovesbusiness.com

Unable to calculate read time

Collection

[

|

...

]