"Constellation posted $6.57 billion in revenue and $3.04 per share in adjusted earnings, both below Wall Street targets. CEO Joe Dominguez called it "outstanding performance" from the nuclear fleet, which generated 46,477 gigawatt-hours in Q3, up from 45,510 a year earlier. Renewable capture rates improved to 96.8%. The company secured a $1 billion government loan to restart the Three Mile Island reactor, backed by a Microsoft power purchase agreement."

"NextEra delivered $7.97 billion in revenue but beat on earnings at $1.13 per share versus the $1.05 estimate. The company added 3 gigawatts to its renewables backlog and announced a 25-year nuclear supply deal with Google to power Iowa data centers. Florida Power & Light contributed $1.46 billion in net income, providing the stable regulated base that funds NextEra Energy Resources' renewable expansion. Management maintained 2025 earnings guidance of $3.45 to $3.70 per share and projected roughly 10% annual dividend growth through 2026."

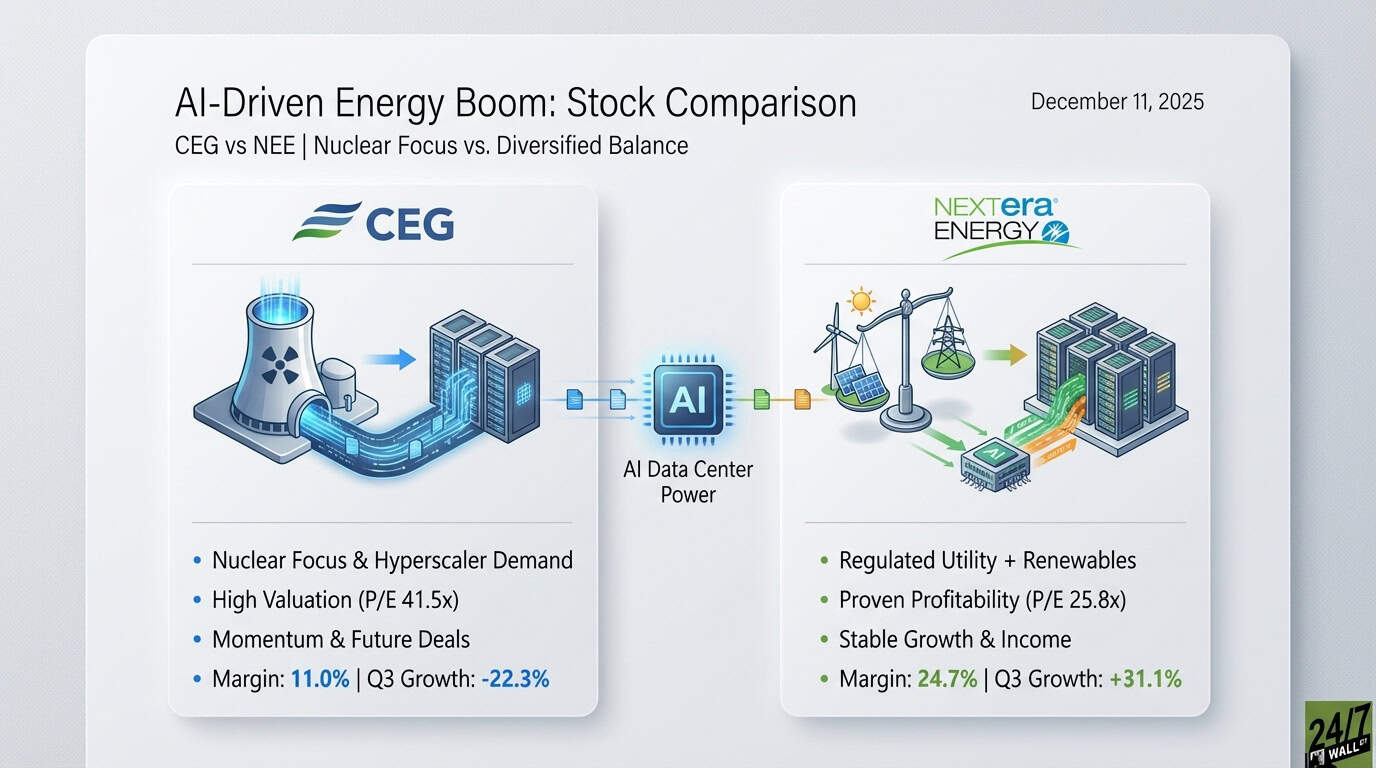

"Constellation trades at 41.5x trailing earnings compared to NextEra's 25.8x multiple, a 61% premium reflecting investor enthusiasm for nuclear exposure to hyperscaler demand. The stock climbed 49% year-to-date through early December versus NextEra's 14% gain. That rally occurred despite a 22% earnings decline in Q3, while NextEra grew earnings 31%. NextEra operates with nearly double Constellation's profit margin at 24.7% and generates more predictable cash flow through its regulated Florida utility."

Constellation reported $6.57 billion in revenue and $3.04 adjusted EPS, below Wall Street targets, with nuclear fleet generation rising to 46,477 GWh and renewable capture at 96.8%. The company secured a $1 billion government loan to restart Three Mile Island, supported by a Microsoft power purchase agreement. NextEra posted $7.97 billion revenue and $1.13 EPS, added 3 GW to its renewables backlog, and agreed a 25-year nuclear supply deal with Google. Florida Power & Light delivered $1.46 billion net income, underpinning regulated cash flow. NextEra maintained 2025 guidance and projected roughly 10% annual dividend growth. Valuation differences are stark: Constellation trades at a much higher earnings multiple while NextEra shows higher margins and steadier utility-backed cash flow.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]