"The divergence within CLOD's portfolio tells the story. Salesforce, the ETF's third-largest holding, dropped nearly 20% in 2025 despite beating earnings estimates in four consecutive quarters, including a 13.6% surprise in December. Meanwhile, Snowflake () surged 44.6% and CrowdStrike (NASDAQ:CRWD) gained 39.4%. These aren't broken businesses experiencing coordinated failure. They're quality assets caught in a sentiment-driven rotation that created a valuation disconnect."

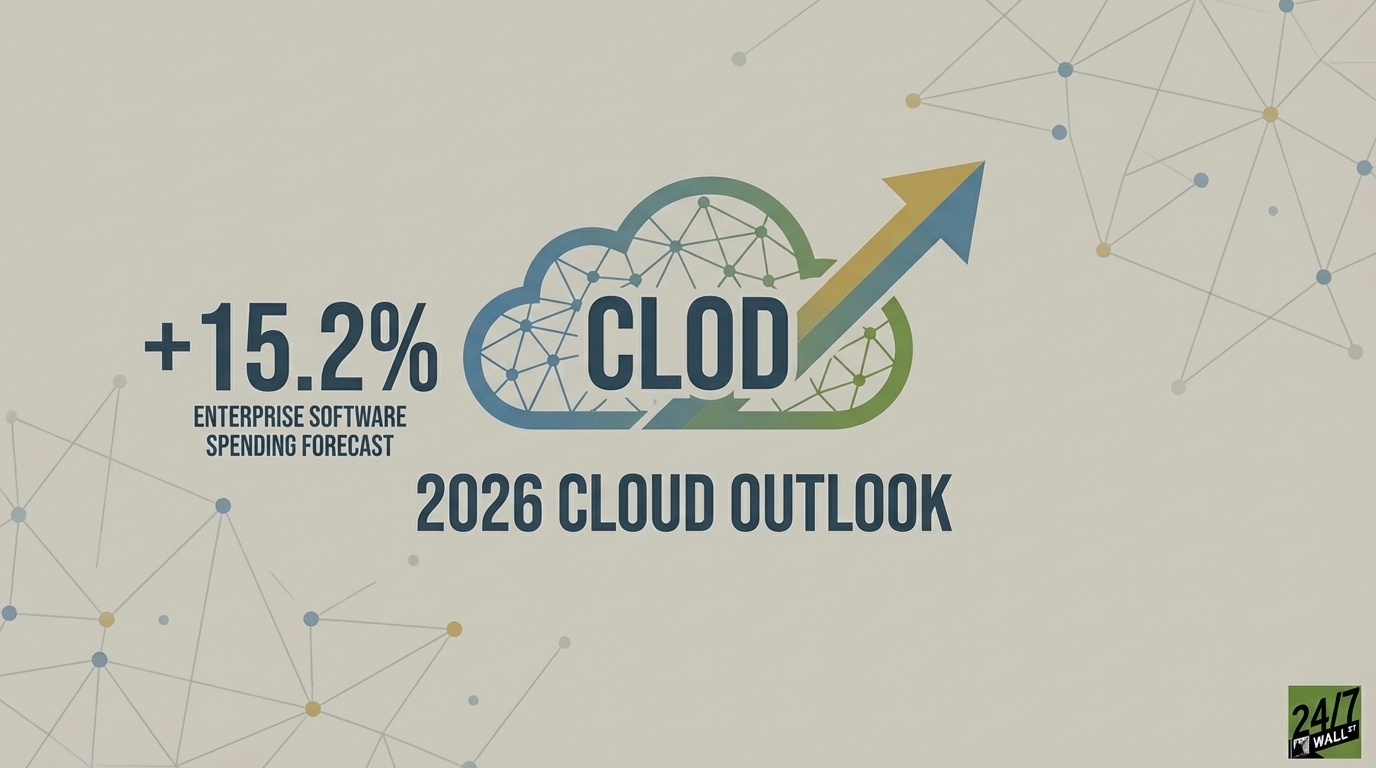

"Gartner (NYSE:IT) forecasts enterprise software spending will grow 15.2% in 2026 to $1.43 trillion, making it the fastest-growing segment of the $6 trillion IT market. Cloud infrastructure spending reached $90.9 billion in Q1 2025 alone, up 21% year-over-year, with the global cloud market approaching $1 trillion. Enterprises abandoned custom AI builds after high failure rates in 2024 proof-of-concept projects. Now they're buying commercial cloud solutions instead of building internally."

CLOD returned 7% in 2025, lagging the Nasdaq-100's 21% gain by over 12 percentage points. The ETF launched in December 2023 with 73% information technology exposure and holds $1.3 million in assets with a 0.35% expense ratio. Top positions include Alphabet (6.2%), AppLovin (5.6%), and Salesforce (5.3%), along with emerging infrastructure names like CoreWeave and Nebius Group. Portfolio divergence saw Salesforce fall nearly 20% while Snowflake and CrowdStrike rallied strongly, producing a valuation disconnect. Gartner projects enterprise software spending will grow 15.2% in 2026 to $1.43 trillion, and cloud infrastructure spending rose 21% year-over-year in Q1 2025.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]