"HYBL serves as a fixed-income position for investors seeking monthly income with moderate credit risk exposure. The fund's return engine operates through three channels: interest payments from high-yield bonds, floating-rate coupons from senior loans, and structured credit returns from CLO tranches. Sub-advised by Blackstone Credit, the ETF uses top-down allocation to shift weights among these three asset classes based on market conditions, paired with bottom-up security selection."

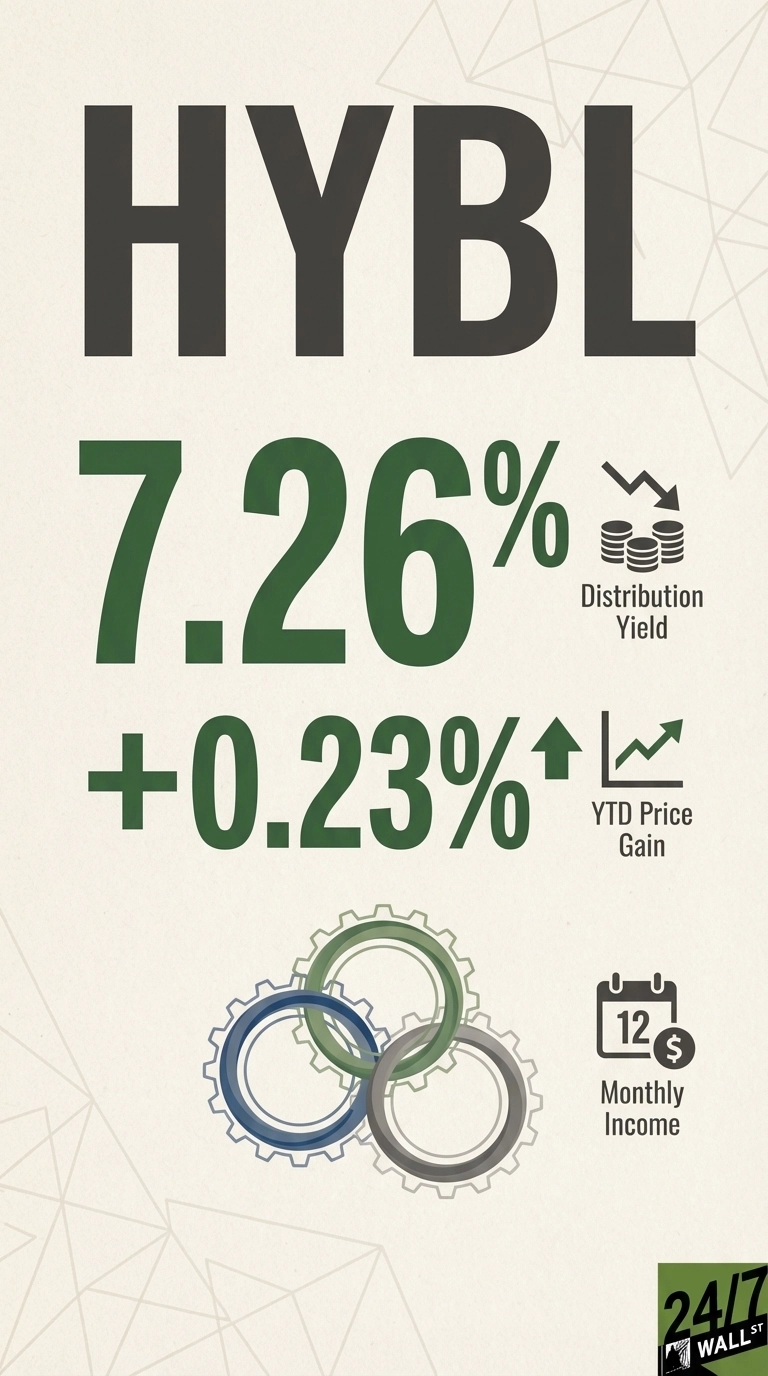

"The strategy targets investors who want exposure to below-investment-grade credit but prefer professional management over direct bond or loan ownership. With 671 holdings and a weighted average all-in rate of 7.06%, the fund distributes income monthly. The 30-day SEC yield stands at 6.76%, though the fund distribution yield based on actual payouts reaches 7.26%."

"HYBL has delivered on its capital preservation mandate in 2025. The ETF opened the year at $28.39 on January 2 and closed at $28.455 on December 12, producing a 0.23% price gain. Including monthly distributions totaling approximately $1.89 per share through December, the total return for 2025 reached 7.38% year-to-date, slightly outperforming the high-yield bond category average of 7.34%. Price volatility has been remarkably low."

SPDR Blackstone High Income ETF (HYBL) mixes high-yield corporate bonds, senior loans, and collateralized loan obligations (CLOs) in an actively managed portfolio. Blackstone Credit sub-advises the fund, using top-down allocation and bottom-up security selection to adjust exposure among the three channels. The fund holds 671 securities, yields a weighted average all-in rate of 7.06%, distributes monthly, and reports a 30-day SEC yield of 6.76% with an actual distribution yield of 7.26%. In 2025 HYBL produced a 0.23% price gain and approximately $1.89 per share in distributions, delivering a 7.38% total return year-to-date with low price volatility.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]