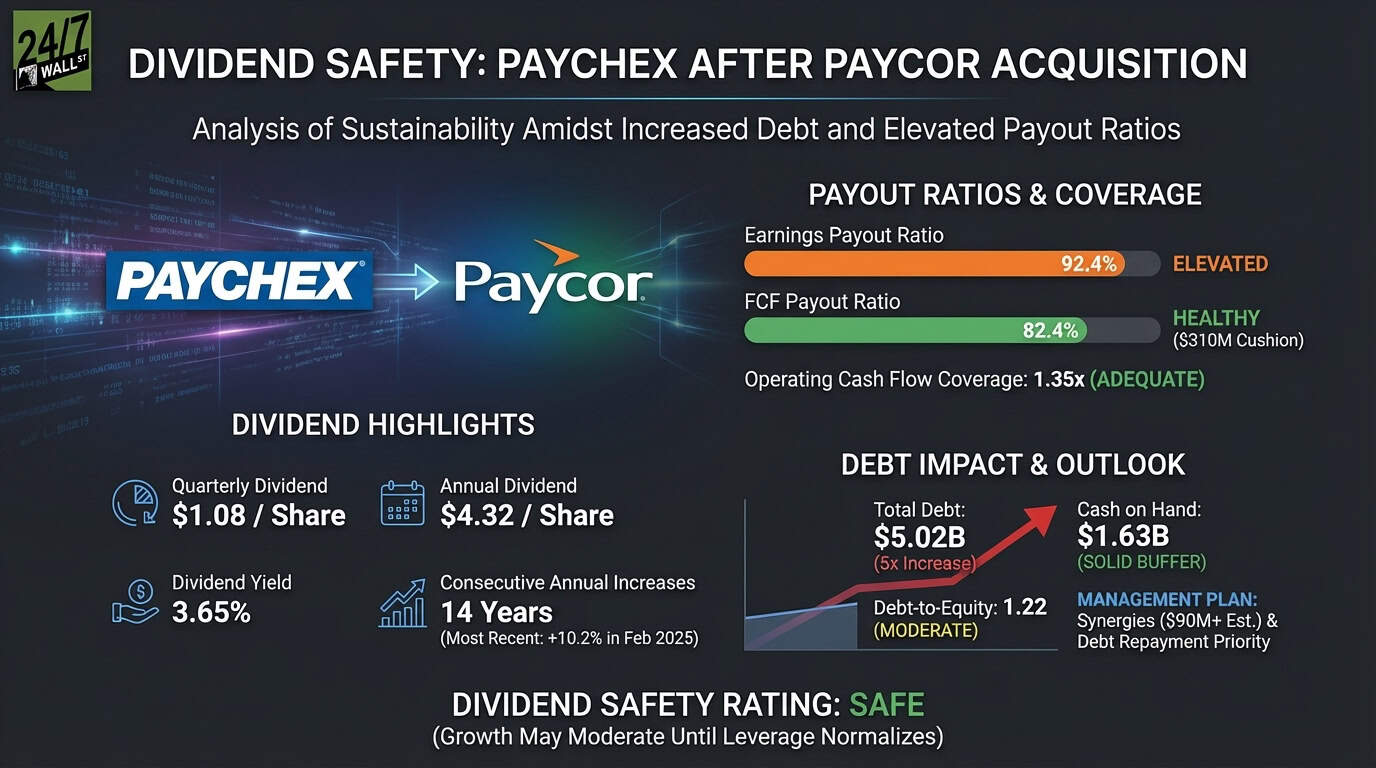

"Paychex generated $1.95 billion in operating cash flow during fiscal 2025 against capital expenditures of $192 million, producing free cash flow of $1.76 billion. The company paid $1.45 billion in dividends, resulting in a free cash flow payout ratio of 82.4%. That leaves $310 million in cushion. The earnings payout ratio tells a tighter story. With diluted EPS of $4.46 and dividends of $4.12 per share paid in fiscal 2025, the earnings payout ratio stands at 92.4%."

"CFO Bob Schrader addressed the debt load on the July 2025 earnings call: "We expect to manage leverage effectively [...] due to two main factors. First, the additional EBITDA generated from this transaction through synergies. Second [...] there is some long-term debt maturing within the next 12 months that we plan to pay down." The company expects $90 million in cost synergies from Paycor in fiscal 2026, up from initial estimates. That additional EBITDA will help service debt and protect the dividend. Operating margins of 39.6% remain industry-leading."

Paychex pays a $1.08 quarterly dividend (3.65% yield) and has increased dividends for 14 consecutive years, including a 10.2% raise in February 2025. Fiscal 2025 produced $1.95 billion in operating cash flow and $1.76 billion in free cash flow after $192 million of capital expenditures. Dividends of $1.45 billion produced a free cash flow payout ratio of 82.4%, leaving a $310 million cash cushion. Earnings payout is higher at 92.4% based on diluted EPS of $4.46. Total debt rose from $866 million to $5.02 billion, pushing debt-to-equity to 1.22. Management expects $90 million in Paycor synergies and plans near-term debt paydowns while prioritizing the dividend.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]