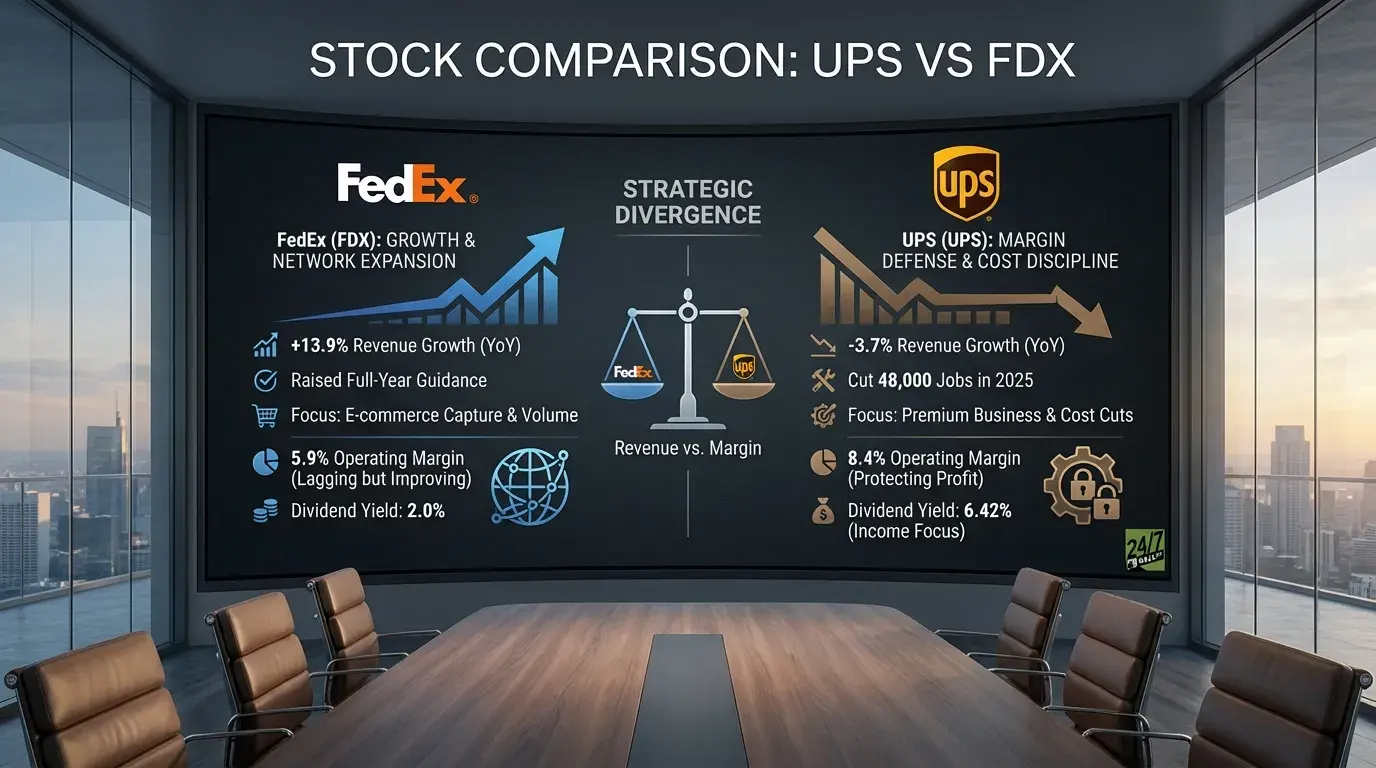

"FedEx delivered a 17.27% earnings beat in fiscal Q2 ended November 30, reporting $4.82 per share against estimates of $4.11. Revenue climbed 13.9% year over year to $23.47 billion, driven by stronger Express segment performance. The company raised full-year revenue guidance to 5% to 6% growth, up from 4% to 6%. Operating margin sits at 5.9%, reflecting ongoing integration and network streamlining costs."

"UPS beat expectations more dramatically in Q3, posting $1.74 per share versus $1.30 consensus, a 33.85% surprise. Revenue fell 3.7% to $21.4 billion as Amazon shipments dropped 21.2%, accelerating from a 13% decline in the first half. UPS cut 48,000 jobs this year, including 34,000 operational roles and 14,000 management positions. The workforce reduction pushed operating margin to 8.4%, well above FedEx's 5.9%. CEO Carol Tomé expects $3.5 billion in cost savings for 2025."

FedEx delivered a 17.27% earnings beat in fiscal Q2 ended November 30, reporting $4.82 per share versus $4.11 estimates. Revenue rose 13.9% year over year to $23.47 billion and full-year revenue guidance was raised to 5%–6%. Operating margin was 5.9% amid integration and network streamlining costs. FedEx is investing in Express and Ground to capture e-commerce share, accepting lower near-term margins while pursuing volume growth and adopting a cautious staffing stance for 2025. UPS beat Q3 expectations with $1.74 per share while revenue declined 3.7% to $21.4 billion as Amazon shipments fell 21.2%. UPS cut 48,000 jobs, closed facilities, completed sale-leaseback transactions, pushed operating margin to 8.4%, and expects $3.5 billion in 2025 cost savings, while a 6.42% dividend yield signals prioritization of shareholder returns and higher-value shipments.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]