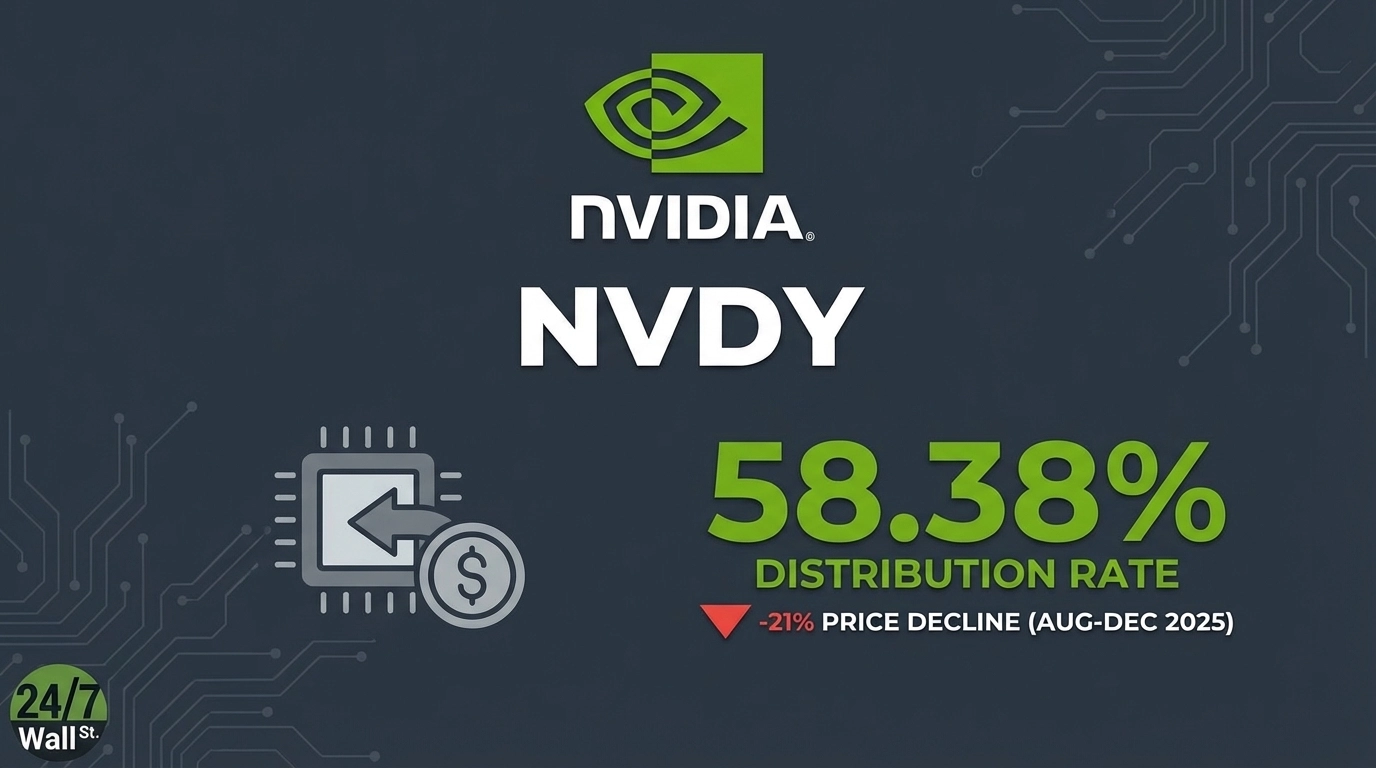

"The fund uses a synthetic covered call strategy, selling call options and spreads to capture premiums while maintaining exposure to the chipmaker's price movements. With a 58.38% distribution rate as of December 10, 2025, NVDY offers income that dwarfs traditional dividend strategies. But the fund's 21% decline from its August peak to $14.10 raises a critical question: are investors earning income or receiving their capital back in installments?"

"NVDY produces distributions by selling call options on Nvidia shares without holding NVDA stock directly. It uses long-dated call options to create synthetic exposure while selling shorter-term calls to collect premiums. This generates substantial income during high volatility, as option premiums increase when prices swing dramatically. Recent distributions illustrate this variability. NVDY paid $0.15 per share on December 12, following payments of $0.16 and $0.15 in prior weeks. However, the fund paid $0.80 on October 10 and $0.32 on November 7."

"NVDY's income generation comes with capped upside and full downside participation. While the fund distributed approximately $11.91 per share over the past year, creating an 84% yield based on current price, the ETF declined from $17.86 in August to $14.10 in December. Investors experienced both generous distributions and substantial capital erosion. The challenge stems from Nvidia's recent volatility. The stock declined 20% from its October peak of $212 to a November low of $170."

NVDY uses a synthetic covered call approach, selling short-term calls and spreads while holding long-dated calls to gain exposure to Nvidia without owning shares. The fund shifted to weekly distributions in October 2025, producing highly variable payouts that have included $0.80, $0.32, $0.16, and $0.15. The distribution rate reached 58.38% as of December 10, 2025, and the fund distributed about $11.91 per share over the past year. The strategy limits upside at sold strike prices while fully participating in downside, contributing to a 21% decline from August to $14.10 amid Nvidia price swings.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]