"record cash flow generation with 149% cash conversion,"

"increasing our interest expense assumption to a low $50 million range due to recent borrowings for the Alloy Steel transaction."

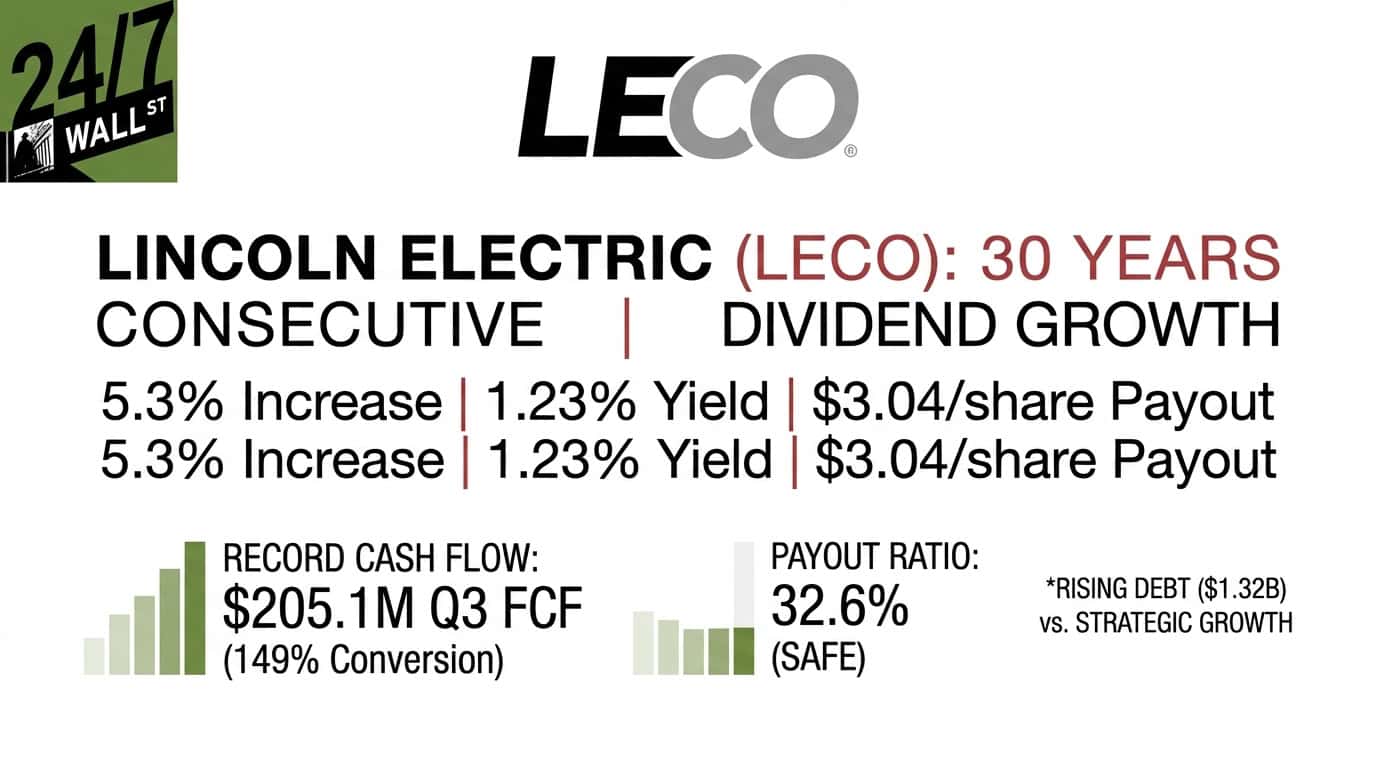

Lincoln Electric raised its quarterly dividend by $0.79, a 5.3% increase, marking a 30th consecutive year of dividend growth and yielding 1.23% with an annual payout of $3.04. Trailing twelve-month diluted EPS of $9.33 produces a 32.6% earnings payout ratio. Q3 2025 free cash flow was $205.1 million (operating cash flow $236.7 million minus $31.6 million capex), while quarterly dividends total about $41 million on 55 million shares, keeping the FCF payout ratio below 50%. Total debt rose 13.8% to $1.32 billion after the Alloy Steel acquisition, with net debt of $939 million and net debt/EBITDA at 1.15x. Interest expense assumptions increased into the low $50 million range, leaving coverage adequate but reducing cash available for dividend growth.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]