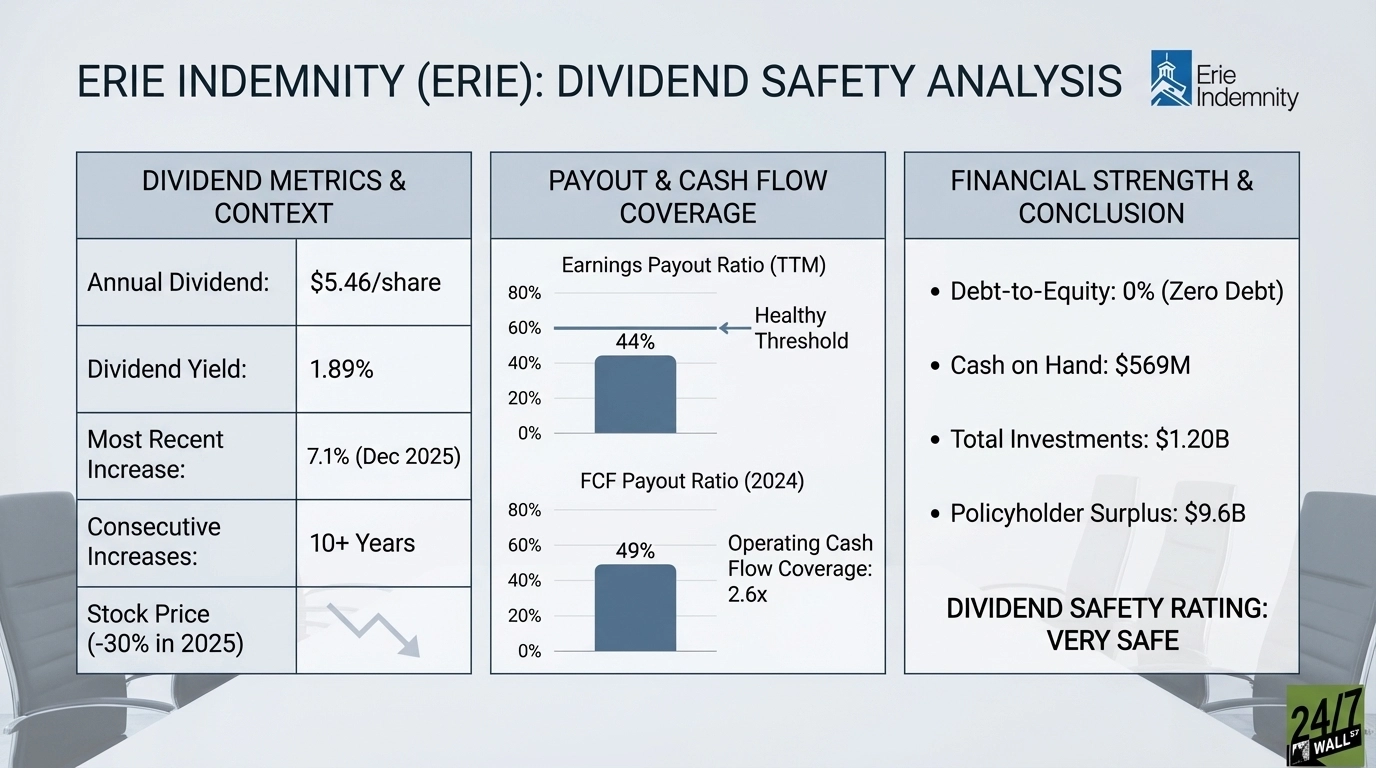

"Erie Indemnity paid $5.46 per share in dividends over the trailing twelve months against earnings of $12.39 per share. That's a 44% earnings payout ratio, well below the 60% threshold I consider healthy. In Q3, the company paid $63.6 million in dividends against net income of $183 million, a 35% payout ratio. The free cash flow picture is equally solid. In 2024, Erie generated $611.3 million in operating cash flow and spent $124.8 million on capex, leaving $486.4 million in free cash flow."

"Against $237.5 million in dividends paid, that's a 49% FCF payout ratio. Operating cash flow covered dividends 2.6 times. The cash flow payout ratio improved from 80% in 2020 to 39% in 2024. The business generates more cash relative to its dividend obligation. Erie Indemnity carries no debt. The company has $569 million in cash and $1.20 billion in total investments against $2.31 billion in shareholder equity."

Erie Indemnity pays a quarterly dividend of $1.4625, payable January 21, 2026, and increased the regular quarterly cash dividend by 7.1%. The company paid $5.46 per share in dividends over the trailing twelve months against earnings of $12.39 per share, a 44% earnings payout ratio. Free cash flow in 2024 was $486.4 million after $611.3 million operating cash flow and $124.8 million capex, yielding a 49% FCF payout ratio against $237.5 million dividends. Operating cash flow covered dividends 2.6 times. The company carries no debt, holds $569 million cash and $1.20 billion investments, and the Exchange maintains $9.6 billion policyholder surplus.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]