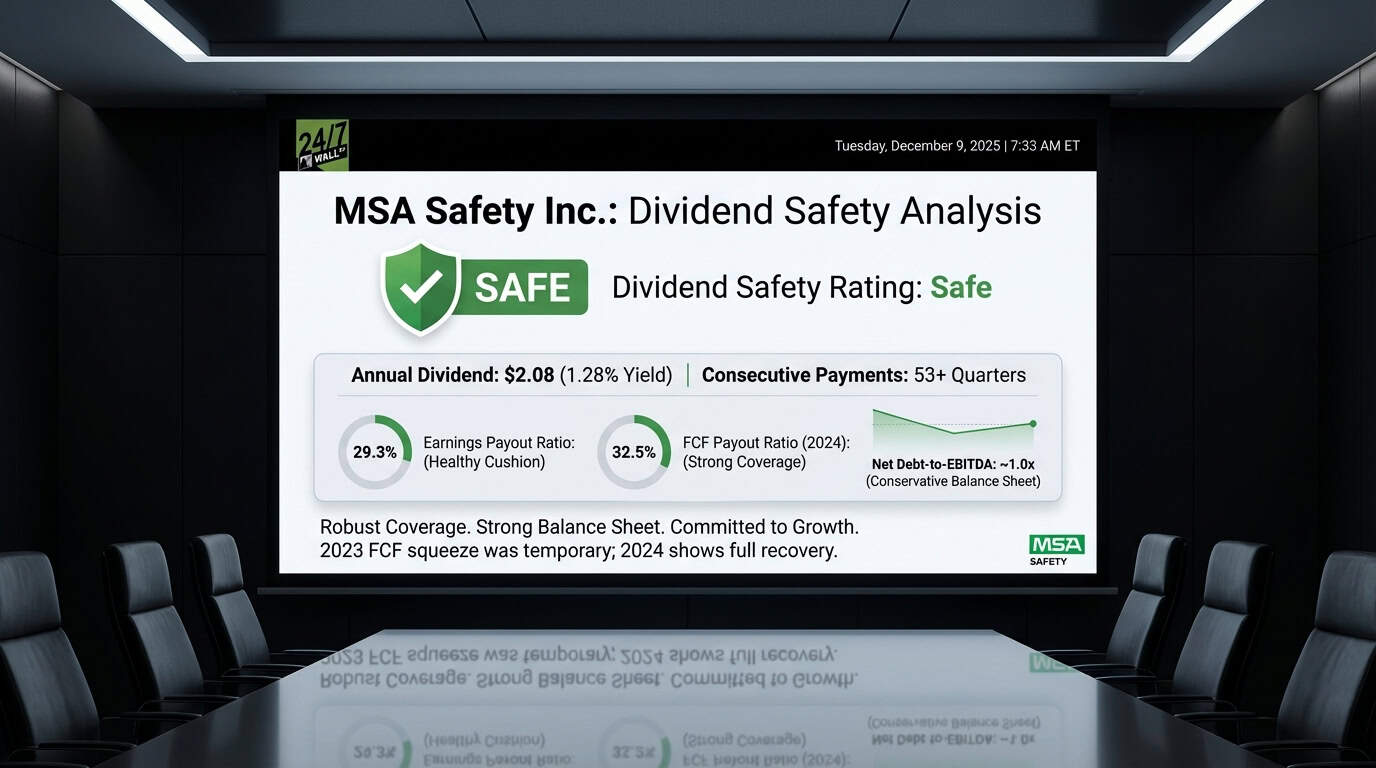

"MSA's dividend coverage is excellent. The company earned $7.09 per share over the trailing twelve months and paid out $2.08, producing an earnings payout ratio of 29.3%. That leaves roughly 71% of profits retained for reinvestment, debt reduction, or further dividend growth. The free cash flow picture requires closer examination. In 2024, MSA generated $296.4 million in operating cash flow, spent $54.2 million on capital expenditures, and delivered $242.2 million in free cash flow."

"But 2023 tells a different story. Operating cash flow collapsed to $92.9 million due to a $51.6 million inventory build. Free cash flow came in at $50.1 million while dividends totaled $73.5 million. The FCF payout ratio spiked to 147%, meaning MSA paid more in dividends than it generated in free cash flow. The company maintained the dividend through that cash flow squeeze, signaling commitment. 2024's recovery demonstrates that 2023 was a working capital anomaly, not a structural problem."

"MSA carries $674 million in total debt against $1.30 billion in shareholders' equity, producing a debt-to-equity ratio of 0.52x. With $170 million in cash, net debt sits around $504 million. Against trailing EBITDA of $491 million, that's a net debt-to-EBITDA ratio of approximately 1.0x. Conservative. Interest coverage is strong. In Q3 2025, MSA reported EBIT of $100.9 million against interest expense of $8.4 million, covering interest payments 12 times over. Debt service is not threatening the dividend."

MSA pays $2.08 per share annually, yielding 1.28%, and has delivered 53 consecutive quarterly payments through December 10, 2025. Earnings of $7.09 per share produced a 29.3% earnings payout ratio, leaving about 71% of profits retained. Free cash flow recovered to $242.2 million in 2024 after a 2023 working-capital-driven decline that pushed FCF payout to 147%. Total debt of $674 million versus $1.30 billion equity yields a 0.52x debt-to-equity ratio and net debt near $504 million. Q3 2025 EBIT covered interest 12 times, indicating strong debt service capacity and dividend support.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]