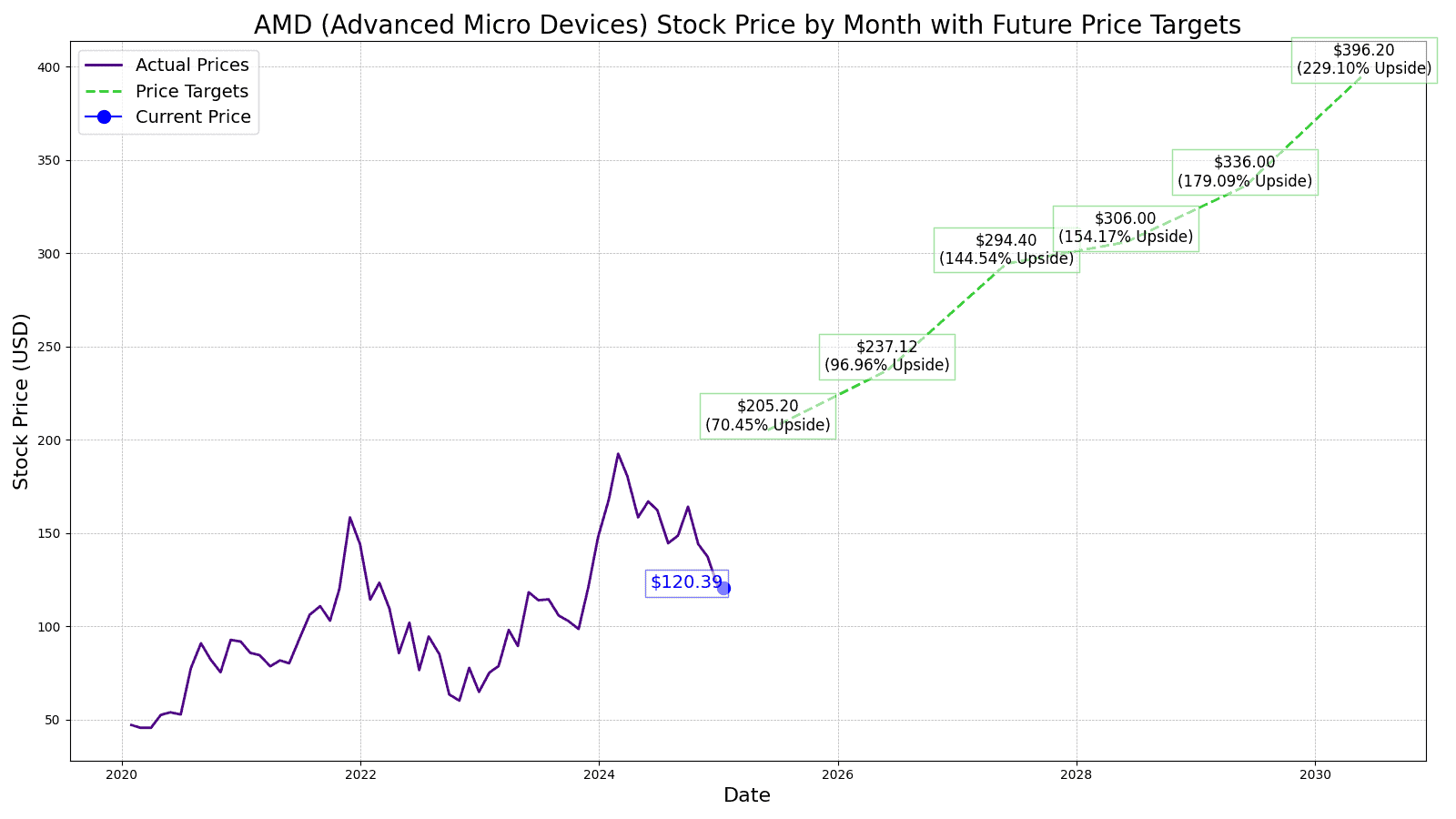

"The fund's income depends entirely on AMD's volatility. With a beta of 1.93, AMD moves nearly twice as much as the broader market, creating rich options premiums. AMD's 52-week range of $76.48 to $267.08 illustrates this volatility-a 249% spread generating substantial options income. In 2025, AMD surged 76.7% through mid-December, significantly outperforming the S&P 500's 16.13% gain. This explosive performance drove elevated options premiums enabling AMDY's triple-digit distribution rate."

"While AMD gained 76.7% in 2025, AMDY delivered a 53.9% price return-capturing approximately 70% of AMD's appreciation. The fund sacrificed 23 percentage points of capital gains for its high distribution yield. More concerning is downside risk. AMD currently trades at $213.43, down 20% from its 52-week high of $267.08. During this decline, options premiums compress, reducing AMDY's distribution potential. The fund offers no downside protection-if AMD falls 30%, AMDY's net asset value falls approximately 30%, and declining volatility simultaneously reduces income generation."

AMDY sells weekly call options on synthetic AMD exposure to generate income, producing a 101.88% distribution rate as of December 17, 2025. The fund's income depends on AMD volatility; AMD has a beta of 1.93 and a 52-week range of $76.48 to $267.08, creating elevated options premiums. AMD surged 76.7% through mid-December 2025, which drove premiums higher and enabled AMDY's triple-digit distribution. The covered-call strategy caps upside participation: AMDY captured about 70% of AMD's 2025 appreciation, sacrificing roughly 23 percentage points of capital gains. The fund provides no downside protection; NAV declines mirror AMD drops and falling volatility reduces income generation. The distribution rate assumes constant weekly payouts despite variable premiums.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]