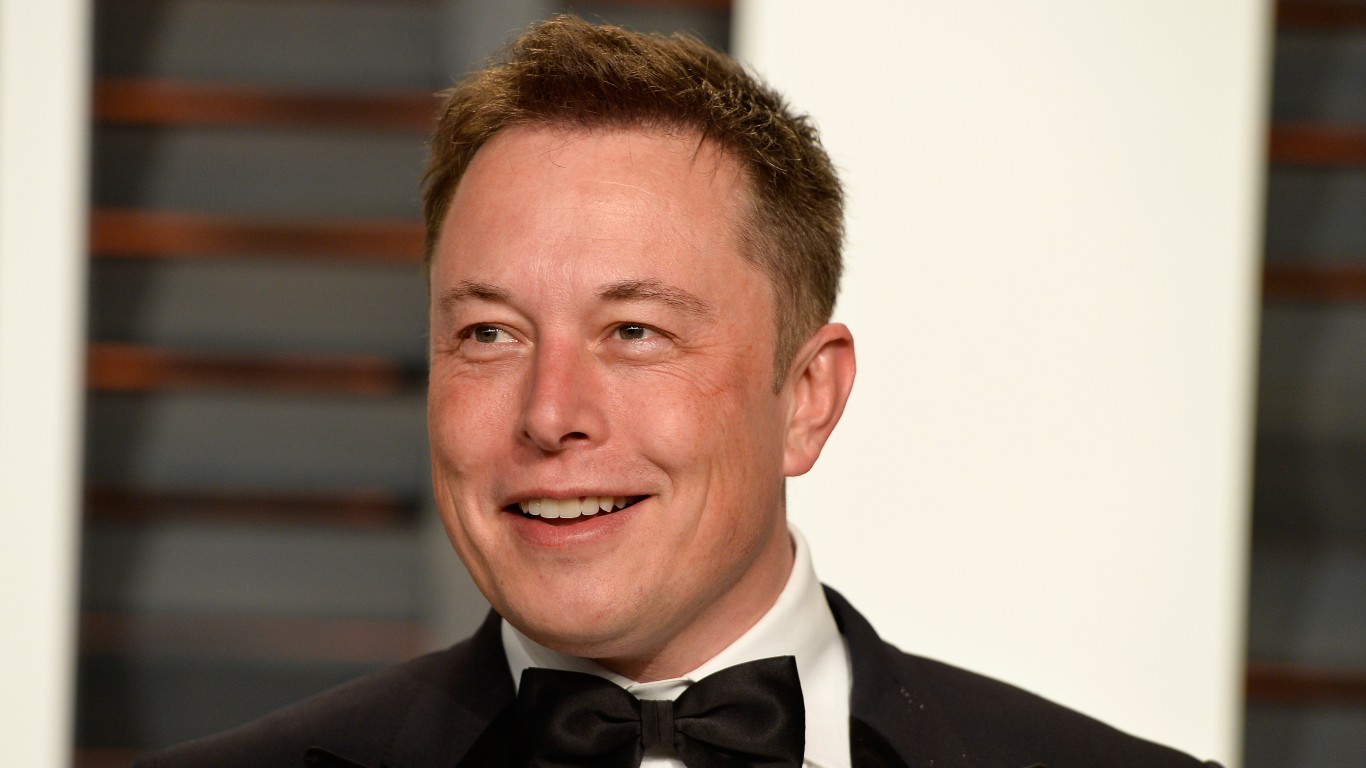

"Elon Musk's massive $1 trillion pay package has been the talk of the town this past week, and it has many Tesla ( NASDAQ:TSLA) shareholders pondering what could happen to the electric vehicle (EV) titan if it ever reached such a fork in the road again. Undoubtedly, Musk is a visionary CEO whose leadership is probably well worth paying up for. And when you buy shares of Tesla, it's as much about the man (the star of the show) rather than the company itself."

"There was a significant divide among some big-name shareholders who opposed Musk's big pay package, while others, including many Elon Musk fans, supported it. As of this writing, it looks like the pay package has been approved with flying colors. Perhaps not all too tough a call to make, given the huge stakes if Musk ever were to depart the firm in response to a rejection of a historic pay package."

"The pay package is shockingly lofty, but one could argue that so too are the conditions that Tesla will need to hit if Musk is to earn such a considerable sum. Undoubtedly, Tesla will need to hit an $8.5 trillion market cap, which seems a tad out of reach today, given the $1.5 trillion market cap. That said, such a more than 500% move, I think, isn't outside the realm of reason within a 10-year timespan."

Elon Musk secured an unprecedented $1 trillion compensation package tied to highly ambitious performance milestones. Shareholders were divided, with some opposing and many supporting the package, and the proposal passed overwhelmingly. The payout requires Tesla to reach an $8.5 trillion market capitalization from roughly $1.5 trillion today, implying more than a 500% increase over the next decade. Many investors buy Tesla primarily for Musk's leadership, creating concern that his departure could trigger significant near-term sell-offs. The plan reflects confidence in long-term execution but depends on meeting extremely challenging targets within ten years.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]