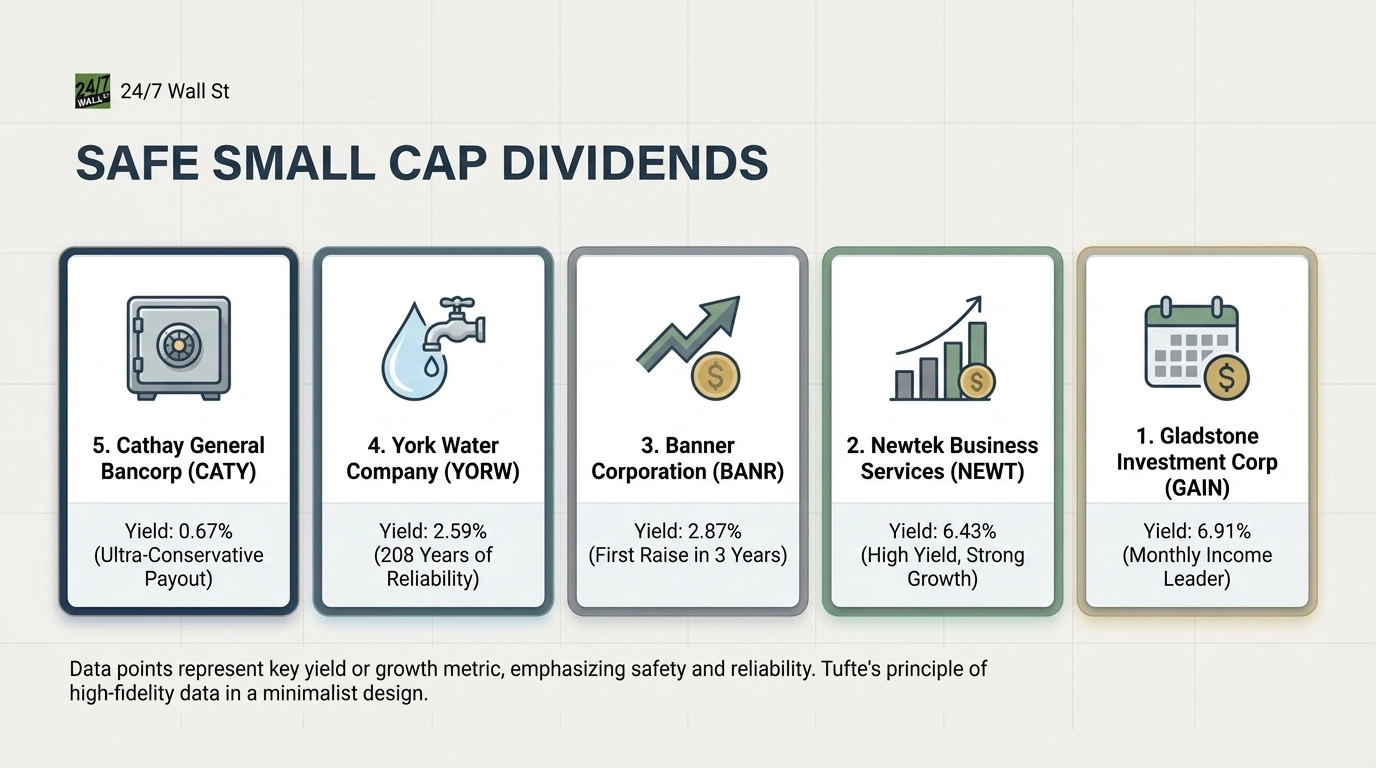

"Small cap dividend stocks offer an appealing combination of income and growth potential, but safety remains paramount for investors seeking reliable distributions. Among sub-$10 billion companies paying dividends, six names stand out for their commitment to shareholder returns backed by operational strength and conservative payout policies. These companies range from a 208-year-old water utility to modern business development corporations, spanning market caps from $349 million to $8.11 billion."

"Cathay General Bancorp ( NASDAQ:CATY) offers the lowest yield at 0.67%, but that ultra-conservative distribution reflects exceptional financial discipline. With a market cap of $3.48 billion, the regional bank reported Q3 net income of $77.7 million despite missing earnings estimates. The bank's payout ratio sits at just 7.9% of earnings, leaving substantial room for dividend growth as management prioritizes capital deployment through share repurchases."

"During Q3, Cathay repurchased $50.1 million in stock at an average cost of $42 per share, part of a $125 million buyback program. Management plans to continue repurchasing approximately $35 million per quarter through Q1 2025. CEO Chang Liu noted non-accrual loans increased to 0.84% of total loans, primarily from a single $38 million relationship. However, the bank maintains strong collateral coverage with an average loan-to-value ratio of 49% across its commercial real estate portfolio."

Six dividend-paying companies with market capitalizations under $10 billion combine income and growth potential while prioritizing dividend safety. Companies include a 208-year-old water utility and business development corporations, with market caps between $349 million and $8.11 billion. Common features include consistent payments, conservative payout ratios, and business models producing predictable cash flows during economic uncertainty. Cathay General Bancorp ( NASDAQ:CATY) exemplifies conservative policy with a 0.67% yield, a 7.9% payout ratio, Q3 net income of $77.7 million, deposits of $20.52 billion, loans of $20.10 billion, and active share repurchases under a $125 million program.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]