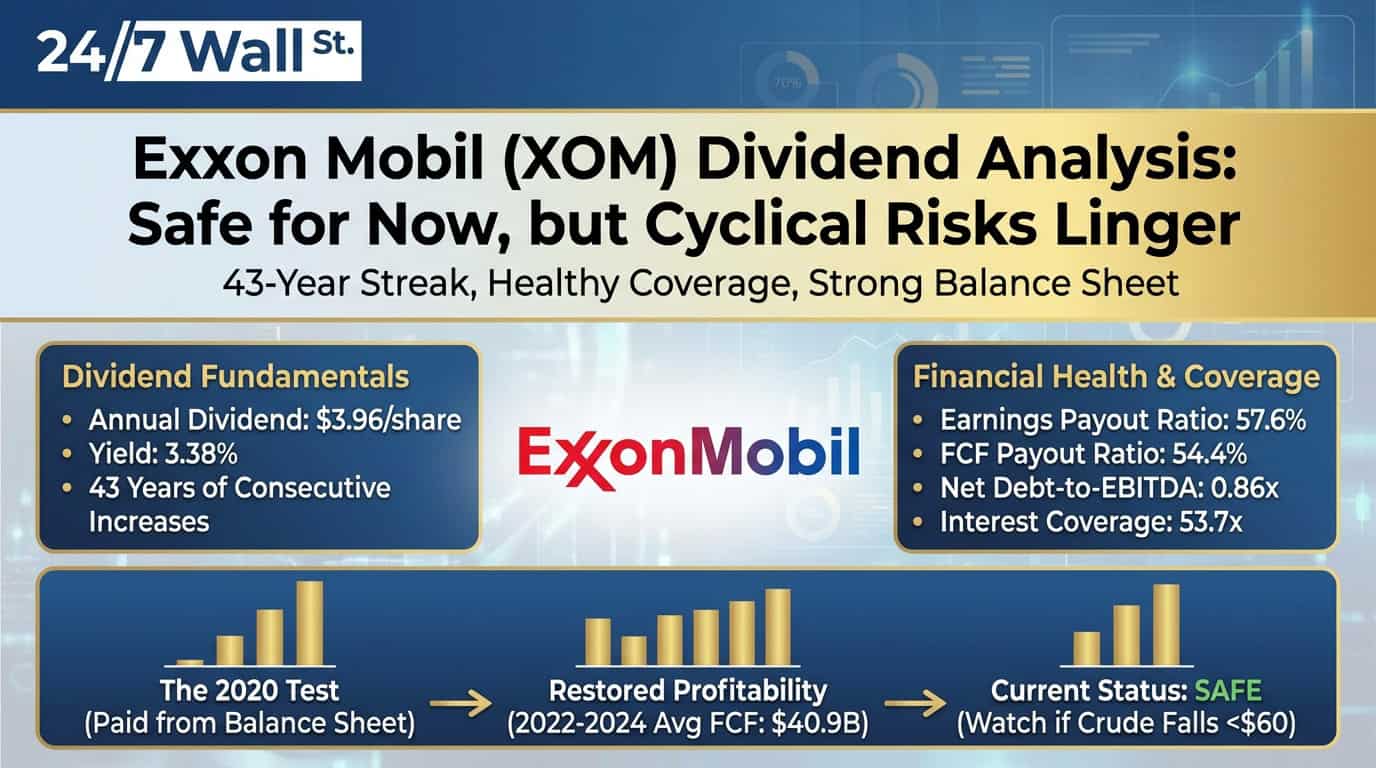

"XOM's earnings payout ratio stands at 57.6%, calculated from TTM diluted EPS of $6.88 against the $3.96 annual dividend. This leaves substantial room even if earnings soften further."

"In 2024, XOM generated $30.7 billion in free cash flow (operating cash flow of $55.0 billion minus capex of $24.3 billion) and paid $16.7 billion in dividends. That produces an FCF payout ratio of 54.4%."

"Net debt of $53.3 billion against EBITDA of $61.7 billion produces a net debt-to-EBITDA ratio of 0.86x. Interest coverage stands at 53.7x, meaning debt service barely registers against operating income."

"XOM's 43-year dividend growth streak survived the 2020 pandemic, but required paying dividends from the balance sheet when free cash flow turned negative. The company paid $14.9 billion in dividends against negative $2.6 billion in FCF that year."

Exxon Mobil pays a $3.96 annual dividend, yielding 3.38%, and has raised dividends for 43 consecutive years. The earnings payout ratio is 57.6% based on TTM diluted EPS of $6.88, leaving room if earnings soften. Free cash flow in 2024 was $30.7 billion after $55.0 billion operating cash flow and $24.3 billion capex, with $16.7 billion paid in dividends for an FCF payout ratio of 54.4%. Net income fell from $55.7 billion in 2022 to $33.7 billion in 2024, while Q3 2025 earnings dropped 12.3% year over year. Net debt of $53.3 billion versus EBITDA of $61.7 billion yields a 0.86x net debt/EBITDA and interest coverage of 53.7x. The company preserved dividends during 2020 by using the balance sheet and averaged $40.9 billion annual FCF from 2022–2024.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]