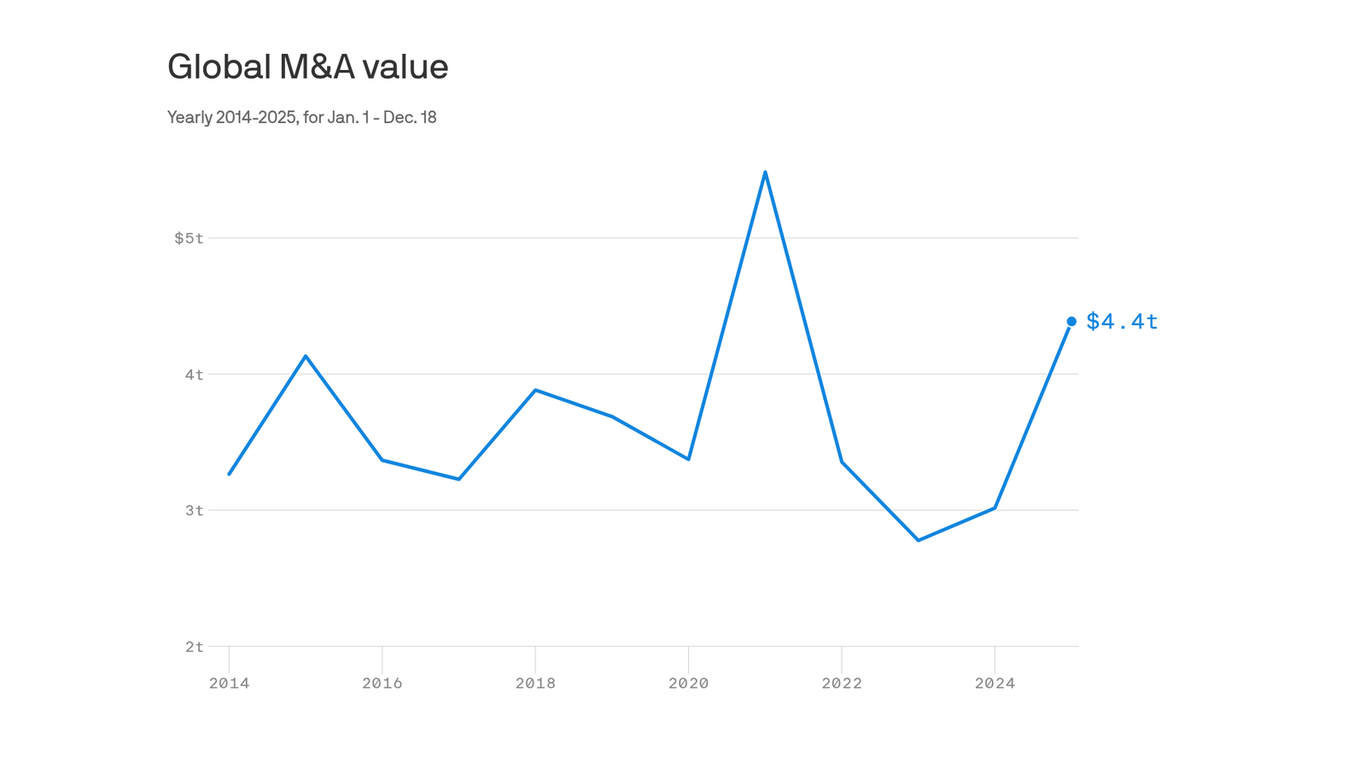

"By the numbers: Global M&A value was around $4.39 billion through Dec. 18, a 45% boost over 2024. The only richer year-to-date was 2021, at $5.48 trillion, while 2015 was the only other year to surpass $4 trillion in deal value."

"The number of deals, however, fell 7% to a nine-year low."

"Zoom in: U.S. dealmaking followed a similar trend in 2025, with $2.23 trillion in M&A value for around 11,300 deals - up 54% and down 14% from 2024, respectively."

"The bottom line: Expect the final figures to be a bit higher, thanks to recent deals like SoftBank agreeing to buy DigitalBridge for $4 billion, Stonepeak paying $6 billion for a majority stake in Castrol, and ServiceNow striking a $7.75 billion deal for Armis."

Global M&A value reached around $4.39 billion through Dec. 18, representing a 45% increase compared with 2024. Only 2021, at $5.48 trillion, exceeded this year-to-date value, with 2015 as the only other year to top $4 trillion. Deal volume decreased by 7%, falling to a nine-year low. U.S. dealmaking mirrored the global pattern in 2025, registering $2.23 trillion in value across about 11,300 deals, up 54% in value and down 14% in deal count from 2024. Final totals are likely to increase because of recent large transactions by SoftBank, Stonepeak, and ServiceNow.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]