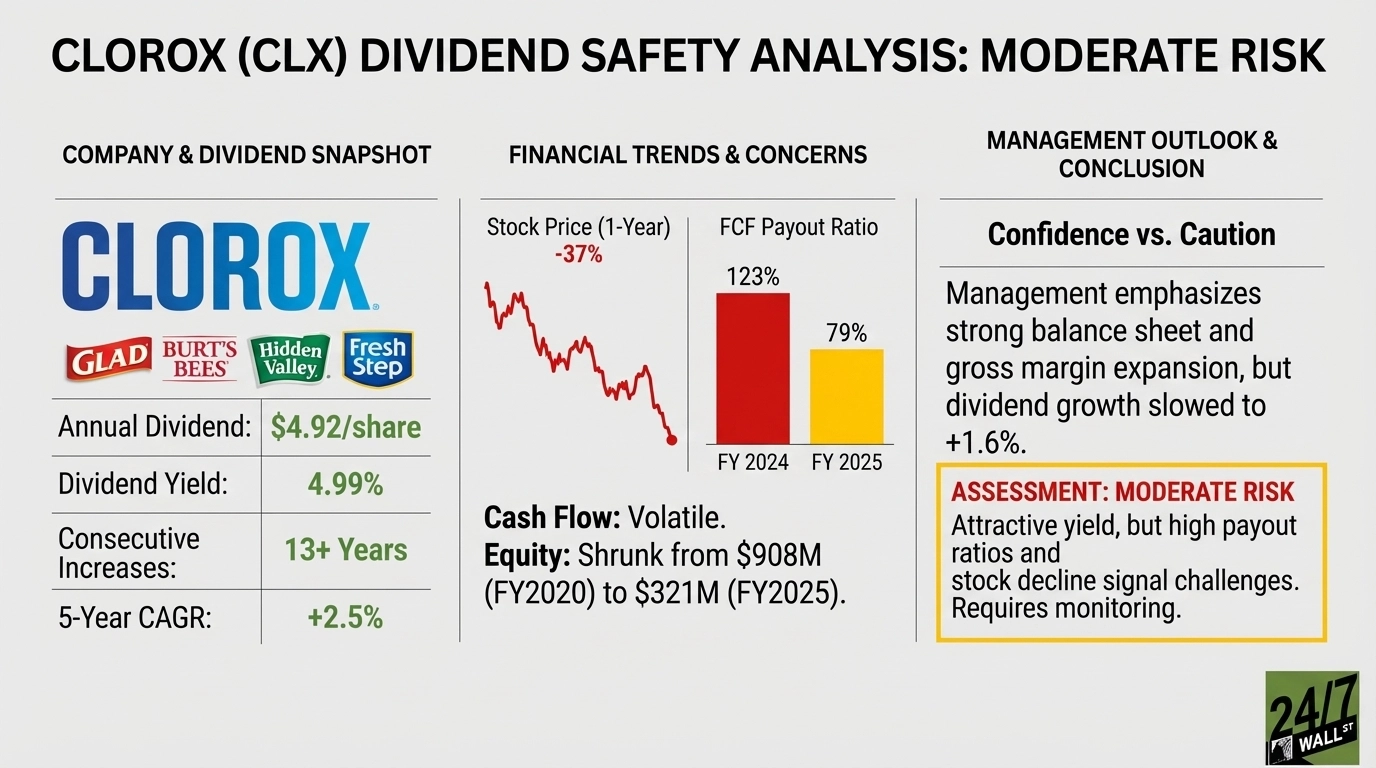

"Clorox paid $602 million in dividends during fiscal 2025 (ended June 30, 2025) against free cash flow of $761 million. That produces a FCF payout ratio of 79%, elevated but manageable. The problem is the trend. In fiscal 2024, the company paid out 123% of free cash flow as dividends-exceeding what the business generated. Operating cash flow has been erratic, swinging from $1.5 billion in fiscal 2020 down to $695 million in fiscal 2024, then back to $981 million in fiscal 2025."

"Clorox carries $2.88 billion in total debt against $167 million in cash, producing net debt of $2.71 billion. With EBITDA of $1.23 billion, the net debt-to-EBITDA ratio sits at 2.4x-manageable for a consumer staples company. The balance sheet concern is shareholder equity, which has declined from $908 million in fiscal 2020 to just $321 million in fiscal 2025. This reflects years of paying out more in dividends and buybacks than the company earned."

Clorox operates household brands including Clorox bleach, Glad, Burt's Bees, Hidden Valley, and Fresh Step. The company pays an annual $4.92 dividend, yielding just under 5%, after a 37% stock decline over the past year. Fiscal 2025 dividends totaled $602 million against $761 million of free cash flow (79% FCF payout), while fiscal 2024 dividends exceeded free cash flow at 123%. Operating cash flow has been volatile across recent years, and the most recent quarter showed dividends exceeding operating cash flow. Net debt is $2.71 billion (about 2.4x EBITDA) while shareholder equity has fallen from $908 million to $321 million; the company repurchased $332 million of shares in fiscal 2025. Management acknowledged near-term challenges while citing gross margin expansion.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]