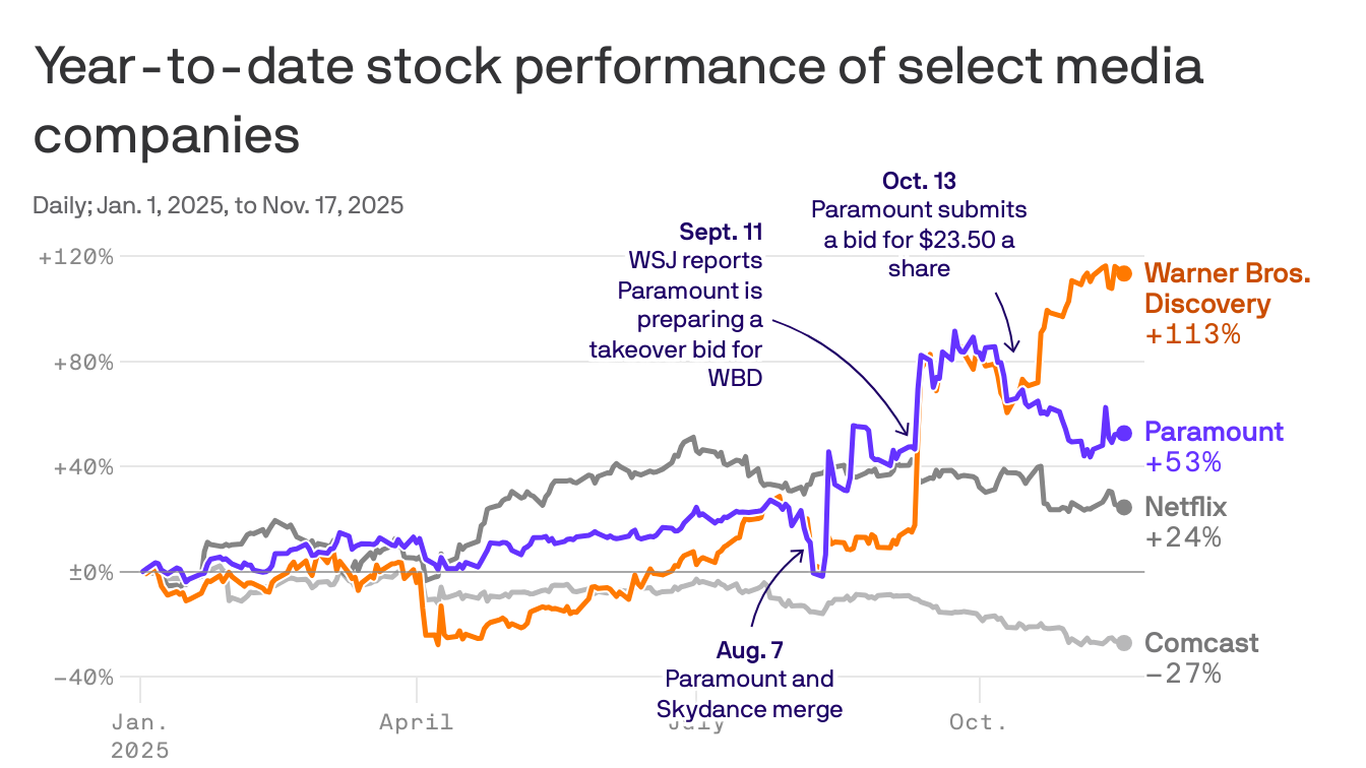

"WBD is hoping to strike a deal by year's end, a source familiar with the board's thinking told Axios. WBD, Comcast and Paramount did not comment. Netflix did not immediately respond to a request for comment. Yes, but: WBD's board wants Paramount to up its latest offer of $23.50 per share to around $30, the source said. Its offer was an 80-20 cash-stock split."

"WBD says it's still considering a plan to split into two publicly traded companies - one focused on its studio and streaming business and the other on its legacy cable networks. The concern with Paramount's previous bids, the source said, is that they devalued the assets more than separating them. Context: WBD's stock price closed at $12.54 on Sept. 10, the day before the Wall Street Journal first reported Paramount's takeover interest. Its share price has since ballooned to $24."

"Paramount's bid is an 87% premium to WBD's pre-deal talk stock price. Paramount has pledged to keep the company together if it purchases the entire company, including its cable assets. Comcast and Netflix areonly interested in WBD's studio and streaming assets, sources said. State of play: A big concern for all parties involved is how regulators would evaluate a deal that combined major streamers, studios and possibly cable behemoths."

WBD hopes to strike a deal by year-end while weighing a potential split into two public companies separating studio/streaming from legacy cable networks. WBD's board wants Paramount to raise its $23.50-per-share offer to around $30; Paramount's offer was structured as an 80-20 cash-stock split. Paramount's bid represents an 87% premium to WBD's pre-deal stock price, and WBD's shares have risen from $12.54 to about $24. Comcast and Netflix are reported to be interested only in the studio and streaming assets. Any acquisition would require DOJ antitrust review rather than FCC approval.

Read at Axios

Unable to calculate read time

Collection

[

|

...

]