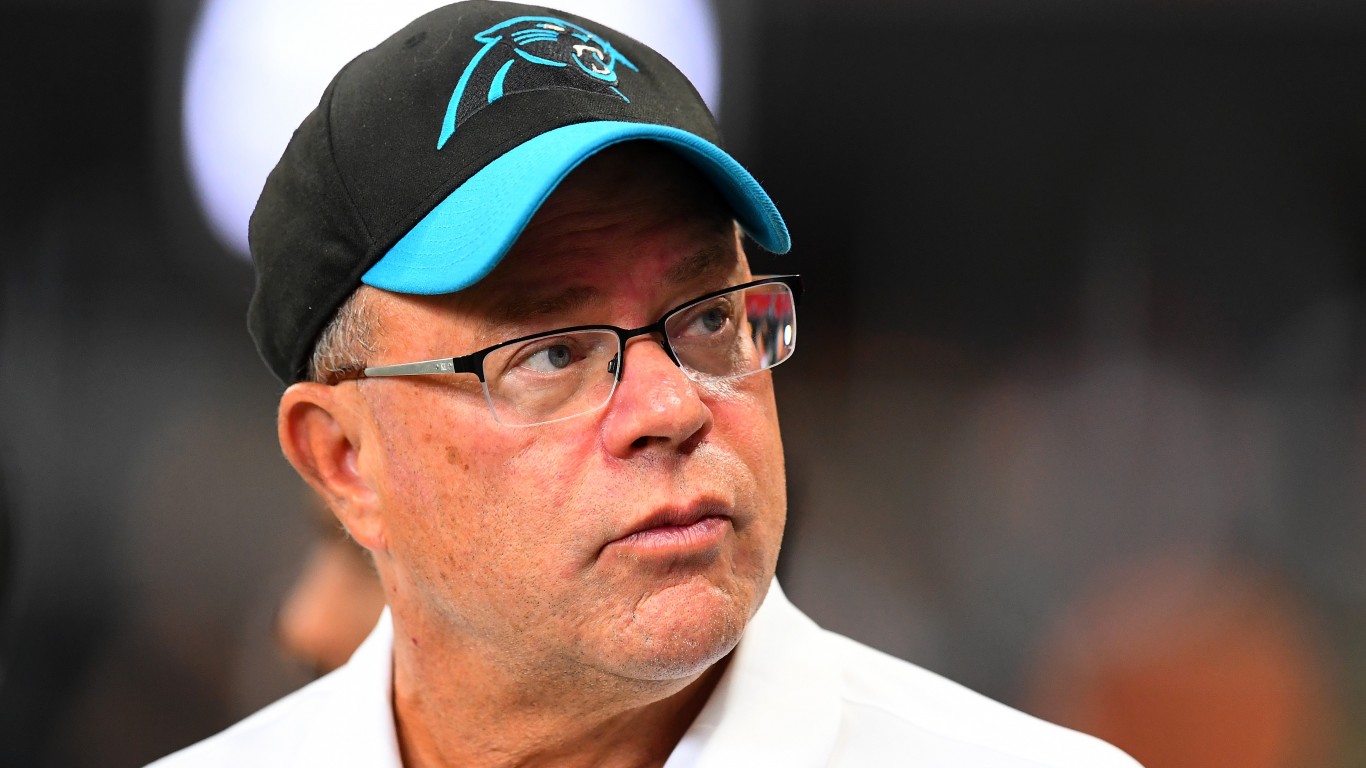

"Billionaire investment legend David Tepper was quite busy in the second quarter, as he added to his stake in a number of intriguing firms, many of which seem to trade at far less than the market multiple. Indeed, by following the moves of such smart money managers, one may get a closer look at where the real value is in the market at any given time."

"Indeed, it's fine to just bet on the broad market indices, but, as I'm sure you've heard many times now, the S&P is carrying a growing degree of concentration risk. So, unless you're fine with more than 7% in Nvidia ( NASDAQ:NVDA) stock or closer to 14% for the Nasdaq 100 index, perhaps it's best to pick and choose one's own name so that their portfolio's fate isn't tied too closely to just a small basket of tech firms."

"Of course, the 13-F filing typically emerges many months later, so investors should expect to pay a different price for entry into a name. Sometimes, one can get an even lower price than their favorite hedge fund manager. Other times, it's costlier to punch a ticket and may not be worth doing, especially if a stock has gained significantly in the past few months."

David Tepper added to positions in multiple companies during the second quarter, notably UnitedHealth (UNH), Nvidia (NVDA), and Intel (INTC). Following smart money managers can help identify where perceived market value resides. Major indices have rising concentration risk, with Nvidia representing a substantial share of the S&P and Nasdaq 100, which can overexpose passive index holders. 13-F filings arrive months after quarter end, so entry prices for retail investors commonly differ from hedge fund purchase prices; entries can sometimes be cheaper and other times costlier. Tepper's Q2 buys have appreciated but may still offer opportunities at current prices.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]