"Priced at $40 during its IPO, CRWV stock skyrocketed 367% to $187 per share by June, fueled by 's ( NvidiaNASDAQ:NVDA) backing through its cutting-edge chips like the RTX Pro 6000 Blackwell and GB300 NVL72 and a $500 million investment. But the hype didn't last long and CoreWeave sank to around $82 per share earlier this month, though they've clawed their way higher again closing yesterday at $122 per share. Yet, CoreWeave keeps winning: multi-year contracts with ( OpenAI and Nvidia bolstered its $20 billion backlog."

"The $14 billion Meta contract is a game-changer, securing dedicated GPU clusters for Meta's Llama models and metaverse projects over five years. It boosts CoreWeave's backlog by 70%, ensuring $2.8 billion in annual revenue at 80% gross margins, according to Zacks estimates. Utilization rates should hit 90% by 2026, driving 40% revenue growth to $1.4 billion next year. Compared to OpenAI's expanded $22.4 billion, four-year deal for ChatGPT capacity, Meta's pact is similar - both lock in high-margin, predictable cash flows."

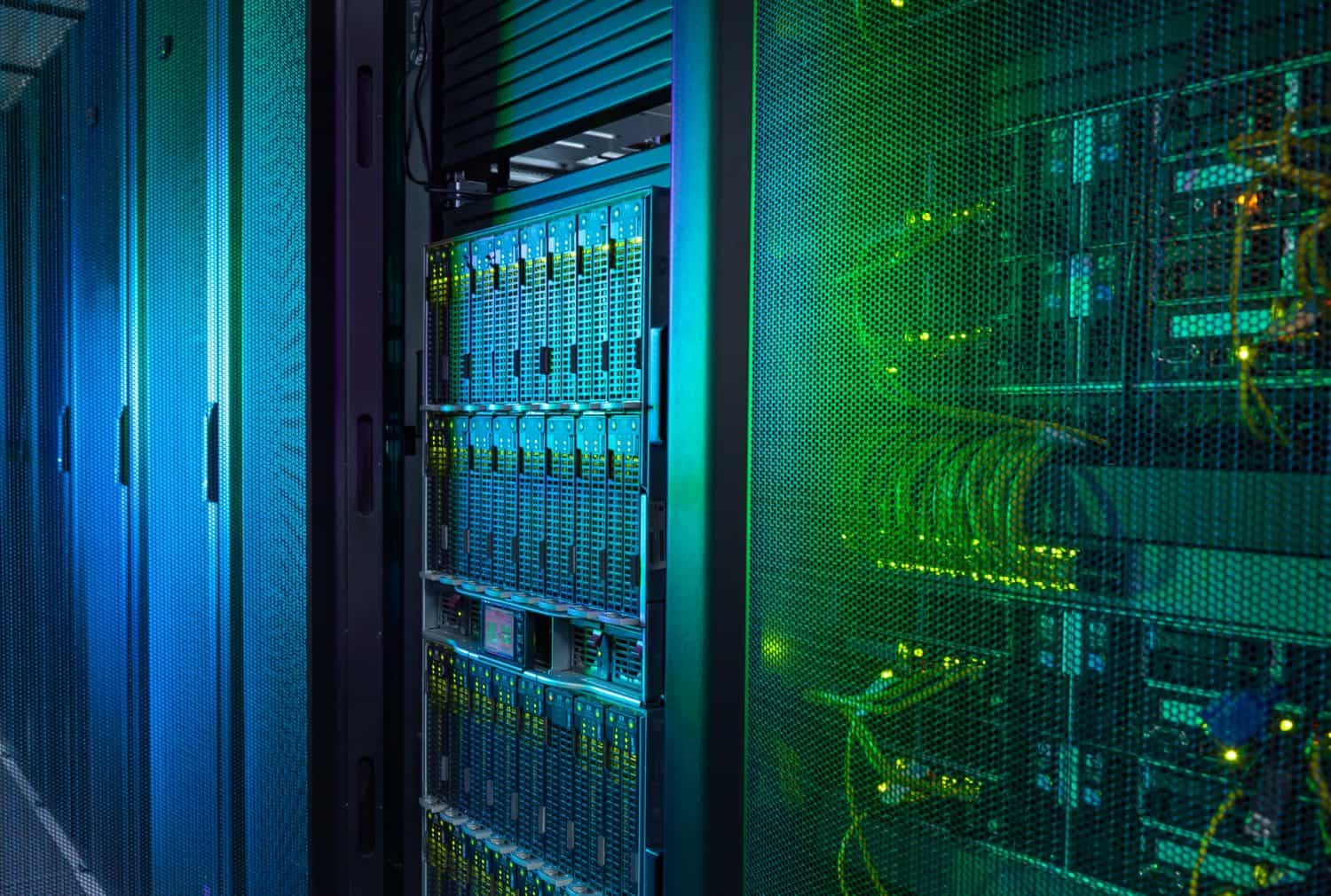

CoreWeave launched publicly in March with a GPU-powered cloud platform optimized for generative AI workloads. The IPO priced at $40 and the stock climbed 367% to $187 by June, supported by Nvidia's chips and a $500 million investment. Shares later fell to about $82 before recovering to $122. Multi-year contracts with OpenAI and Nvidia created a roughly $20 billion backlog. A new $14 billion, five-year Meta deal increases backlog by 70%, implying about $2.8 billion annual revenue at 80% gross margins per Zacks. Utilization is expected to reach 90% by 2026, driving 40% revenue growth next year. A $6.3 billion agreement with Nvidia reduces GPU costs through scale.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]