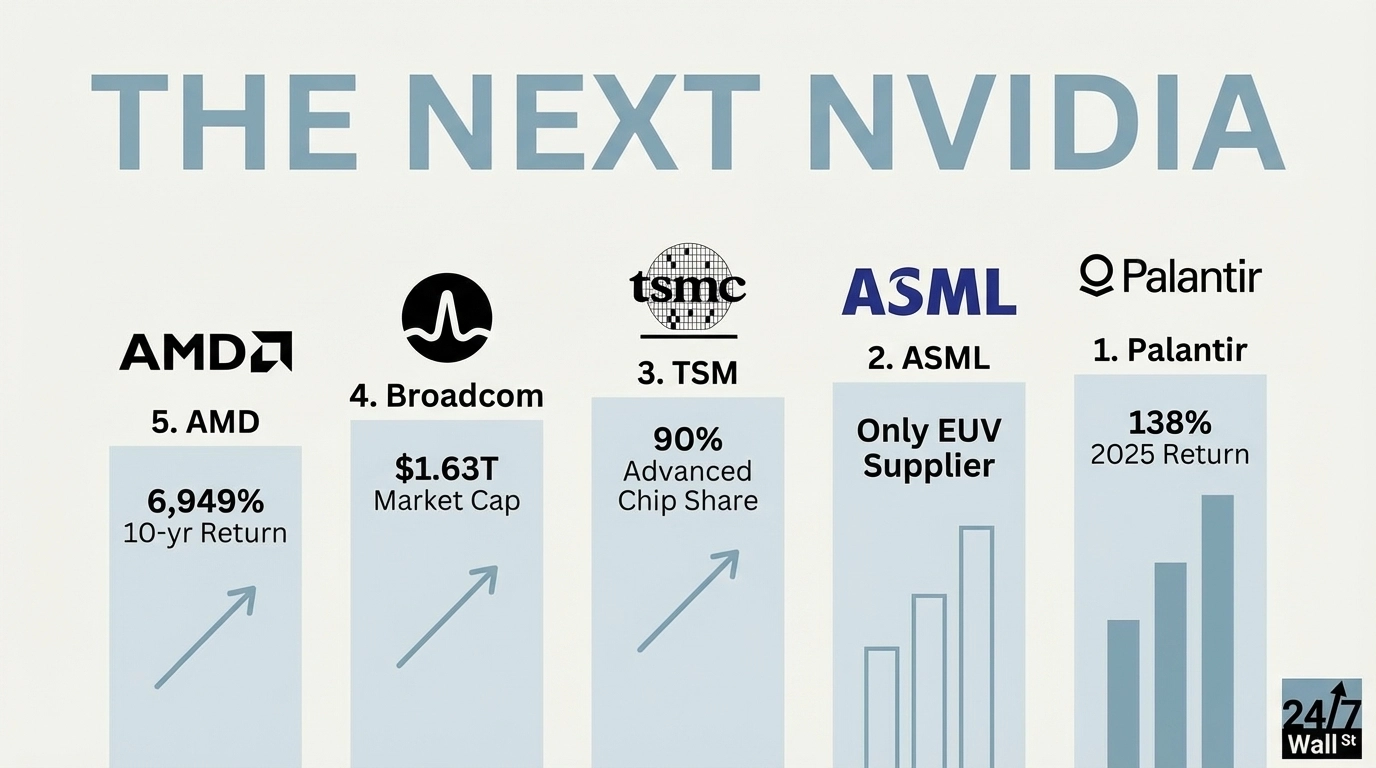

"NVIDIA ( NASDAQ:NVDA) has delivered a 23,000% return over the past decade has become the benchmark every tech investor measures against. The company created the infrastructure that made modern AI possible. Now the question: which company pulls off the next NVIDIA-like run? We analyzed 15 AI-adjacent stocks across semiconductors, software, and quantum computing to find the five with the clearest path to impressive future returns thanks to massive growth in the decade ahead. Here's what separated the contenders from the pretenders."

"Advanced Micro Devices ( NASDAQ:AMD) delivered a 6,949% return over the past decade. MI300 AI accelerators have gained traction against NVIDIA's H100 chips, particularly among hyperscalers diversifying their AI infrastructure. The next battle will pit AMD's MI400 series against NVIDIA's Blackwell series. AMD generated $32.0 billion in trailing revenue with 36% year-over-year growth. The company's 100x P/E prices in continued market share gains, but AMD needs to prove it can sustain momentum beyond initial MI300 wins. Operating margins of 14% lag far behind NVIDIA's efficiency, and gross margins of 52% leave limited room for price competition. The thesis hinges on whether AMD can capture 20% of the AI accelerator market by 2027. If it does, current valuations look reasonable. If NVIDIA maintains its 80% share with Broadcom in second place, AMD becomes an expensive also-ran."

"Broadcom ( NASDAQ:AVGO) already achieved what most " next NVIDIA " candidates aspire to: a $1.63 trillion market cap built on actual profits. The company generated $63.9 billion in trailing revenue with a 36% profit margin. What makes Broadcom compelling is its custom AI chip business. While NVIDIA sells standardized accelerators, Broadcom designs bespoke silicon for Alphabet ( NASDAQ:GOOGL), Meta Platforms ( NASDAQ:META), and other hyperscale"

NVIDIA produced a 23,000% return over the past decade and created core infrastructure enabling modern AI. Fifteen AI-adjacent stocks across semiconductors, software, and quantum computing were compared to identify five with the clearest paths to outsized future returns. Advanced Micro Devices returned 6,949% over the past decade and gained traction with MI300 accelerators, but faces valuation and margin pressure unless it captures roughly 20% of the AI accelerator market by 2027. Broadcom achieved a $1.63 trillion market cap, generated $63.9 billion in trailing revenue with a 36% profit margin, and grows via custom AI silicon for hyperscalers.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]