"For now, it's... not. The Vanguard S&P 500 ETF ( NYSEMKT: VOO) is actually looking pretty healthy so far, up 0.2% premarket. And why is that? Perhaps investors are thinking all these layoffs, caused by cheap AI replacing expensive workers, and allowing corporate profits to rise. Or investors could be encouraged by the way oral arguments went before the Supreme Court yesterday, with the Justices apparently doubtful of President Trump's ability to legally and unilaterally impose tariffs on imports without Congressional assent."

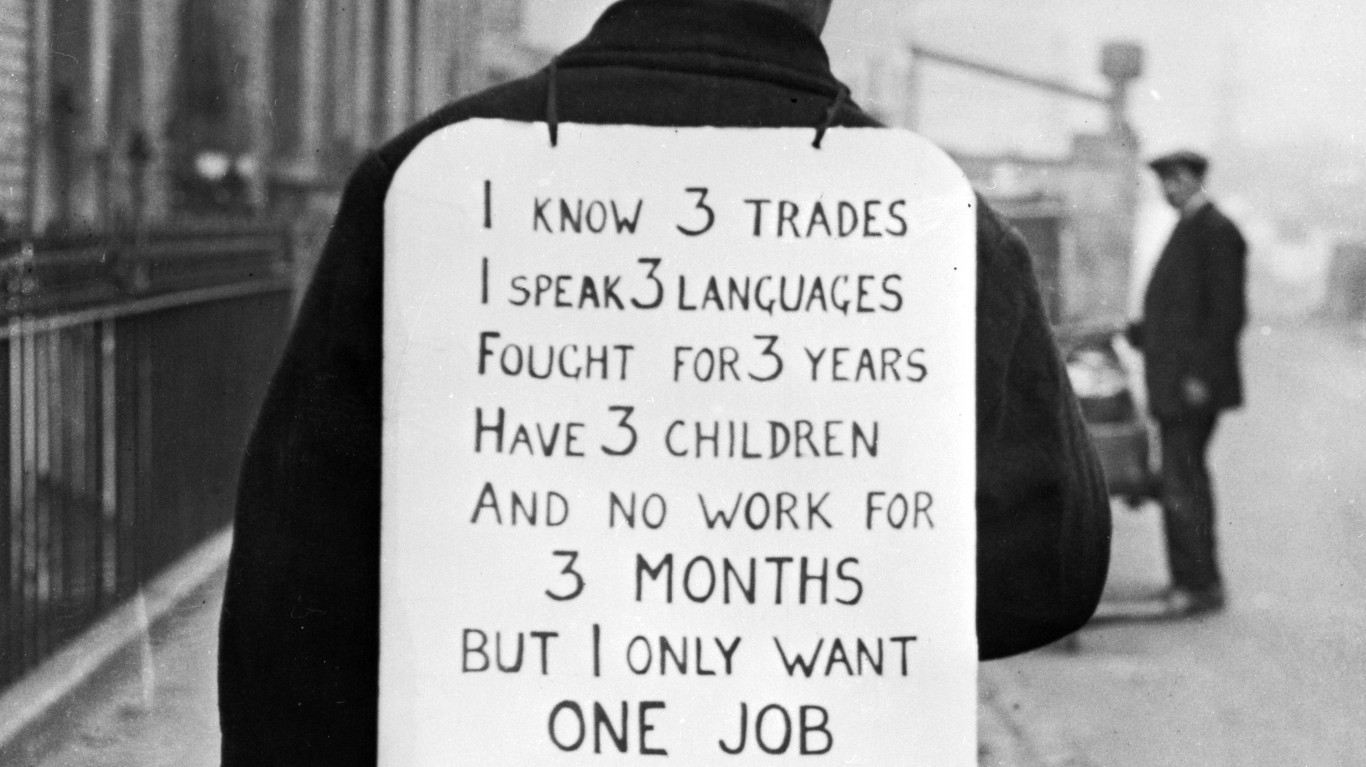

"One day after HR company Automatic Data Processing estimated private payrolls grew by 42,000 in October, outplacement firm Challenger, Gray & Christmas has just released a report estimating job cuts in October totaled 153,074, nearly triple September's layoffs and up 175% from October 2024. With the federal government shut down and no official government data to confirm or deny Challenger's data, or put it in a broader context, today's news has the potential to shake the market."

Private payroll estimates and outplacement reports diverge sharply: ADP estimated a 42,000 gain in private payrolls while Challenger, Gray & Christmas reported 153,074 job cuts in October, a large increase from prior months. The federal government shutdown prevents official confirmation of employment trends, adding uncertainty. The Vanguard S&P 500 ETF (VOO) traded higher premarket, as investors weigh potential profit gains from labor-cost reductions through AI and possible tariff rollbacks after skeptical Supreme Court oral arguments. Corporate earnings showed weakness, with DuPont missing expectations and warning of lower full-year profit prospects, yet markets remained resilient.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]