#financial-planning

#financial-planning

[ follow ]

#retirement #inheritance #retirement-planning #real-estate #retirement-savings #horoscope #personal-finance

from24/7 Wall St.

5 days agoMy husband makes 4-times the money I do, and I'm afraid of being treated unfairly when we retire

Discrepancies in salaries within a marriage are common and can stem from differences in career fields, education, work experience, or personal choices about balancing family and professional life. While income gaps don't inherently cause problems, they can create tension if couples don't openly communicate about expectations, financial responsibilities, or feelings related to money and contribution. Some partners may feel pressure, guilt, or resentment depending on who earns more, while others may struggle with societal norms around gender and income.

Relationships

Venture

fromFortune

2 weeks agoAfter selling his business for $532 million, this millennial says a life of leisure was surprisingly 'boring', so he's choosing to go back to work | Fortune

Sudden multimillion-dollar wealth did not bring fulfillment; post-exit life required new skills, purpose, and deliberate financial adjustment beyond money.

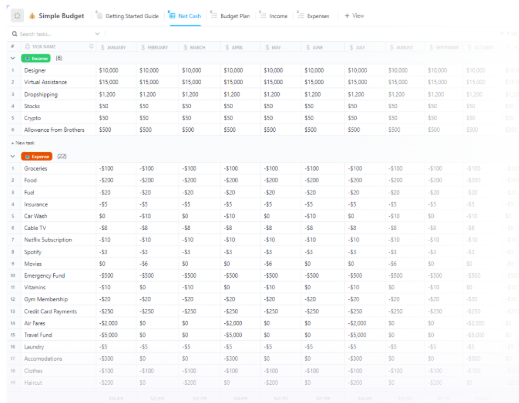

fromIndependent

2 weeks ago'It was a hard-earned lesson on how to budget and make your money last' - how to financially plan for a career break

The prospect of taking an extended unpaid break from work can be daunting. But with the right financial planning, it can be an opportunity to pause, spend time with family and explore new avenues

Wellness

Real estate

fromRedfin | Real Estate Tips for Home Buying, Selling & More

4 weeks agoUnderstanding Home Buyer's Remorse and How to Avoid It

Home buyer's remorse arises from financial strain, rushed decisions, overlooked location, underestimated maintenance, or emotional pressure; reduce it with budgeting, patience, and planning.

Women

fromFortune

1 month agoWomen could fall behind in the $124 trillion Great Wealth Transfer because of the 'confidence gap' in financial planning, finance experts say | Fortune

Women stand to inherit 70% of a $124 trillion Great Wealth Transfer but risk falling behind due to lack of financial planning and confidence.

fromFast Company

1 month agoGLP-1s are reshaping bodies and budgets

But that same morning, a $900 charge for her GLP-1 prescription landed on her credit card. Whatever she was saving at the supermarket felt dwarfed by the cost of her medication. Drugs like Ozempic, Wegovy, Mounjaro, and Zepbound are being hailed as medical breakthroughs. They're not just changing waistlines-they're changing household budgets. And as these shifts ripple through everyday spending, the financial industry has an important role to play in helping people rethink, rebalance, and plan for this new reality.

Public health

Business

fromFortune

1 month agoMorgan Stanley's head of financial planning on 4 steps you can take to start building generational wealth | Fortune

A sound financial plan defines goals, guides decisions, manages risk, and builds wealth while protecting future needs and enabling intergenerational transfer.

from24/7 Wall St.

1 month agoThe Top 10 Most Popular Strategies for Reducing Taxes in Retirement

You worked hard for your money all your life so keeping the greatest part of it out of the taxman's icy grip begins by planning early. There are numerous paths to take to minimize your retirement tax bill, and some are quite complicated and complex strategies that need years of planning to come to fruition. Because retirement planning is no longer a straightforward effort, consult with a tax professional and a financial planner early on to make best use of the options available.

Business

US politics

fromFortune

1 month agoWhite House layoff threats and the greatest resignation in American history highlight paycheck uncertainty-here's how to prepare if it happens to you | Fortune

Immediately review severance, enroll in unemployment and health coverage as needed, and create a clear financial snapshot to manage sudden income loss.

Travel

fromBusiness Insider

2 months agoI spent my 20s living a dream life abroad, but returned to the US in debt. There's a lot I wish I'd done differently.

Moved to Budapest at 23 and lived seven years abroad, gaining experiences but becoming financially unstable from low pay, poor planning, and weak credit-card rewards.

Startup companies

fromBusiness Insider

2 months agoAfter learning about investments on social media, my teen met with a financial planner. Now he's saving for his retirement.

A motivated teen pursued entrepreneurship, part-time work, and early investing, and became the primary decision-maker in establishing an investment plan with a financial advisor.

Business

fromFortune

2 months agoHow a willingness to take risks positioned one executive to ride the biggest wealth wave in history | Fortune

Aneri Jambusaria shifted from a scarcity to an abundance mindset, delegated more, pursued bigger opportunities, and is driving LPL's wealth-management growth and advisor adoption.

from24/7 Wall St.

2 months ago12 Things Not to Do If You Win the $1.3 Billion Lottery

It is sad, but a modicum of research shows that not signing a ticket or failing to report to the state are the simplest and most common errors to make. Can you imagine losing a lottery ticket? Then imagine what can happen if someone else snags your ticket and shows up to collect the prize. Fighting over true ownership of a lottery ticket is not a simple task, and many disputes have arisen over who owns what ticket.

US news

fromBusiness Insider

3 months agoI quit my job at Google after 2 years. I prepared well for my exit but wish I'd done 3 things differently.

I set aside extra money for my kids, mortgage, bills, and car payments. My original goal was to reach $12,000 in savings. That way, when I started my coaching business, I could jump right into it without affecting my family financially. I ultimately reached about $10,200 before my exit. I'm glad I did that because it gave me some peace, and I wasn't thrown into a scarcity mindset when I left.

Careers

from24/7 Wall St.

3 months ago12 Things Not to Do If You Win the $600 Million Lottery

Some people actually choose the lottery annuity payment rather than taking a lower lump-sum payment. Some lottery winners give most of their winnings away or buy too many new things for themselves, friends, and family. Could you imagine winning $50 million or $100 million and then being broke? Many lists have been directed at newly rich lottery winners, but surprisingly, there are few warnings for lottery winners.

US news

fromwww.housingwire.com

3 months ago8 Steps to Creating a Real Estate Business Plan (+ Free Template)

A real estate business plan isn't just something you create once and forget about. It's a living document that helps you make smart decisions, stay focused on what matters and grow intentionally. Without a plan, it's easy to fall into a cycle of chasing whatever's in front of you including leads, listings, transactions without ever stopping to ask whether it's actually moving you closer to your goals. A good business plan will give you that clarity.

Real estate

Retirement

fromLondon Business News | Londonlovesbusiness.com

3 months agoThe risks and benefits of SIPPs (Self-Invested Personal Pensions) in the UK - London Business News | Londonlovesbusiness.com

Self-Invested Personal Pensions (SIPPs) offer greater investment freedom but require careful management to avoid potential pitfalls.

from24/7 Wall St.

3 months agoI Used to Think a 529 Was the Perfect Educational Savings Vehicle, Until I Learned These Drawbacks

Families may find the benefits of 529 plans are overshadowed by considerable penalties for non-qualified withdrawals, restrictions on investment choices, and complex rules that could hinder financial planning.

Education

Real estate

fromRedfin | Real Estate Tips for Home Buying, Selling & More

3 months agoWhat is lender-paid mortgage insurance (LPMI) and how does it work?

Lender-paid mortgage insurance (LPMI) simplifies homeownership by incorporating mortgage insurance costs into the interest rate, benefiting some but potentially increasing long-term expenses.

from24/7 Wall St.

4 months agoMy tech job pays great but immigration uncertainty and layoffs have me nervous - is it smart to sell my properties at a loss and leave the U.S.?

This Redditor highlights their feelings of unease amidst a tough time in the United States due to the current political climate and job insecurity.

Canada news

[ Load more ]