"EPS follows the WisdomTree U.S. LargeCap Index, weighting its 500 holdings by earnings generation rather than market cap. Companies producing more profits get larger allocations, creating a natural quality tilt without complex factor screens. NVIDIA (NASDAQ:NVDA) holds the top spot at 7.2%, followed by Amazon (NASDAQ:AMZN) at 6% and Alphabet (NASDAQ:GOOGL) at 6%, while Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) receive smaller allocations than in market-cap weighted funds."

"Information technology commands 31% of assets, but the 15% financial allocation provides defensive ballast through dividend payers like JPMorgan Chase (NYSE:JPM). The bank's 1.7% dividend yield and 16% earnings growth exemplify the income-plus-appreciation combination retirees need. Healthcare (13%), consumer discretionary (11%), and industrials (9%) round out the top sector allocations, while the tech overweight captures growth without concentrated single-stock risk."

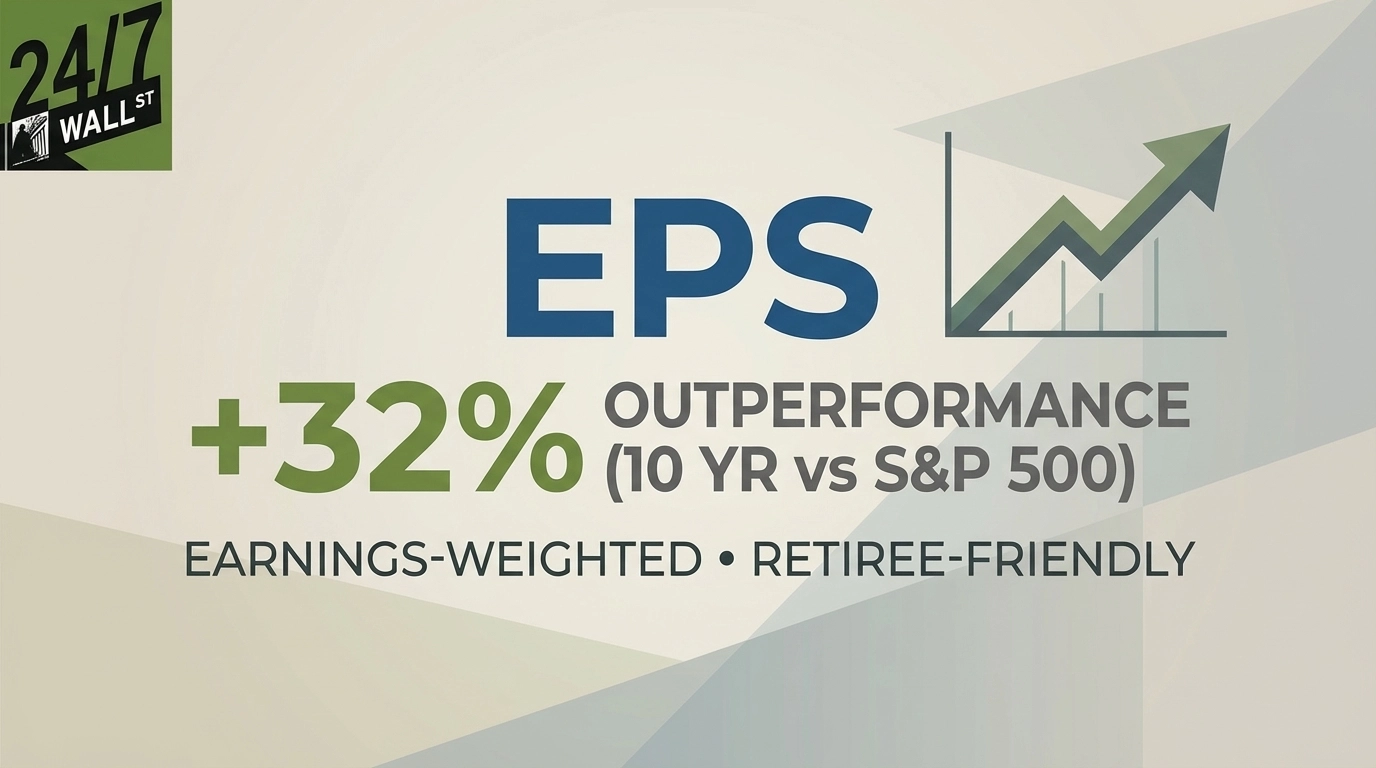

EPS follows the WisdomTree U.S. LargeCap Index, weighting 500 holdings by earnings generation rather than market capitalization. Heavier allocations go to more profitable companies, producing a natural quality tilt and limiting exposure to unprofitable growth names. Over the past ten years EPS returned 266.34% versus the S&P 500's 234.36%, outperforming by roughly 32 percentage points. The fund charges a 0.08% expense ratio and posts about 16% annual turnover, preserving investor returns and minimizing taxable distributions. Sector weights include 31% information technology, 15% financials, 13% healthcare, 11% consumer discretionary, and 9% industrials. Quarterly dividends yield about 1.3% while offering capital appreciation to support retiree withdrawals.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]