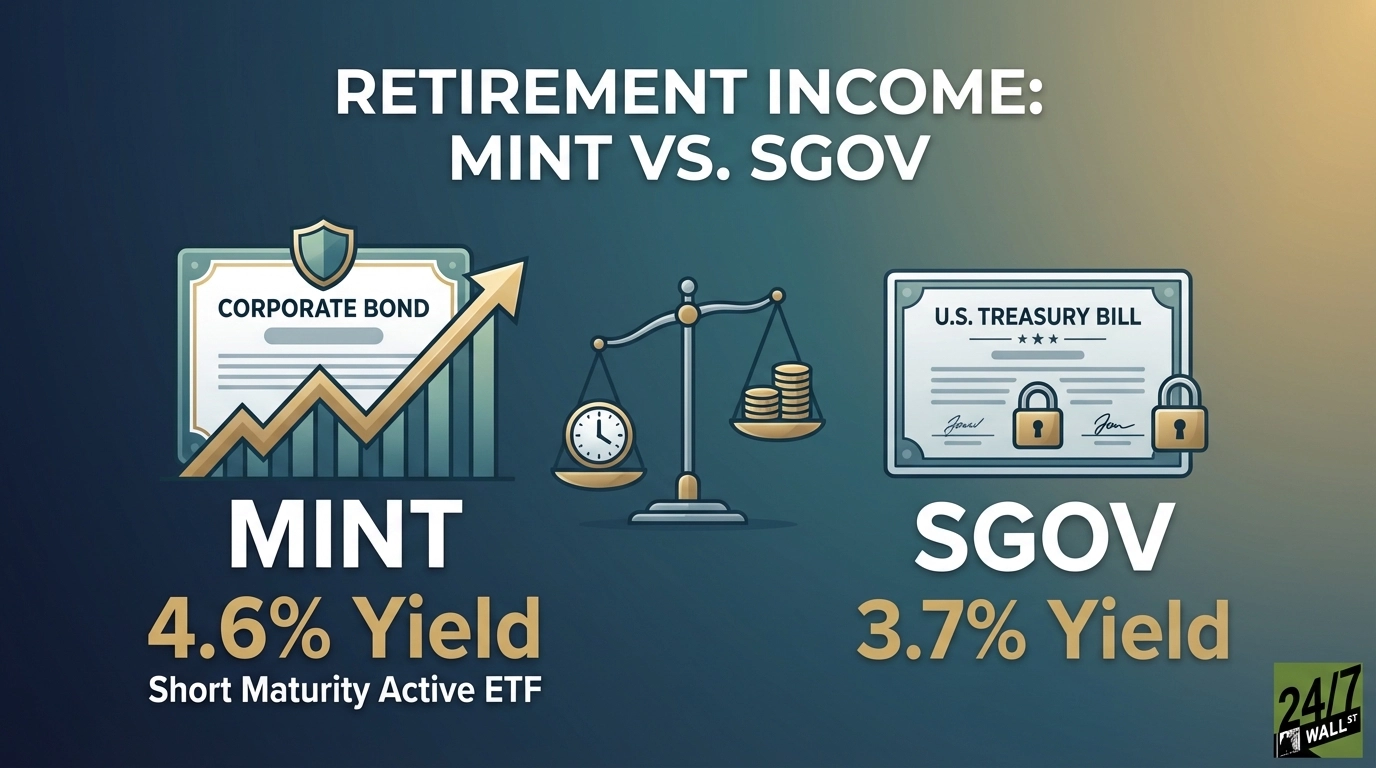

"PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (NYSEARCA:MINT) offers retirees a 4.6% yield by focusing on short-term bonds that mature in under three years. This short duration strategy aims to deliver steady monthly income while protecting capital from the interest rate swings that punish longer-term bonds. Since launching in 2009, MINT has built a reputation for reliable monthly income, providing the consistency retirees need."

"The fund's Achilles heel is its direct dependence on short-term interest rates. When rates decline, monthly dividends contract as the income stream falls with the rate environment. This vulnerability means MINT's yield rises and falls with prevailing rates rather than underlying corporate earnings, creating income uncertainty for retirees who depend on stable distributions. PIMCO's active management comes at a cost, with a 0.36% expense ratio that exceeds passive alternatives."

"Income alone doesn't tell the full story for retirees who need their portfolios to last. While MINT's recent performance looks respectable, the five-year picture reveals limitations with an annualized 3.2% return that barely keeps pace with inflation. Nearly flat prices since 2021 mean returns depend almost entirely on distributions that rise and fall with rates. Retirees seeking stable income with minimal volatility should consider iShares 0-3 Month Treasury Bond ETF (NYSEARCA:SGOV) as an alternative."

MINT targets short-term bonds maturing in under three years to produce a 4.6% yield with a short-duration approach that emphasizes steady monthly income and capital preservation. The fund has provided consistent monthly distributions since 2009 and shows limited price volatility. Reliance on short-term rates causes dividends to shrink when rates fall, creating income variability for retirees. Active management carries a 0.36% expense ratio and the fund manages $14.6 billion. Five-year annualized return of 3.2% barely outpaces inflation. SGOV offers a lower-cost, lower-risk ultra-short Treasury alternative yielding 3.7%.

Read at 24/7 Wall St.

Unable to calculate read time

Collection

[

|

...

]