"In 2015, for example, the reign of the Zombie Formalism trend died of a 7% contraction in global sales. In Miami that year, Jeffrey Deitch and Larry Gagosian mounted the figurative group show Unrealism in its wake, officially anointing figuration as the art market's next big thing. The art economy recovered, and figuration ascended until the next inflection point in 2022,"

"Each of these trends underwent textbook asset price inflation, whereby low interest rates send the demand for excess wealth storage skyrocketing-one of many ways financialisation has fundamentally changed the culture of collecting. Now in the third consecutive year of contraction, high prices are under scrutiny as being out of sync with real long-term value, as well as a barrier to entry for potential new collectors."

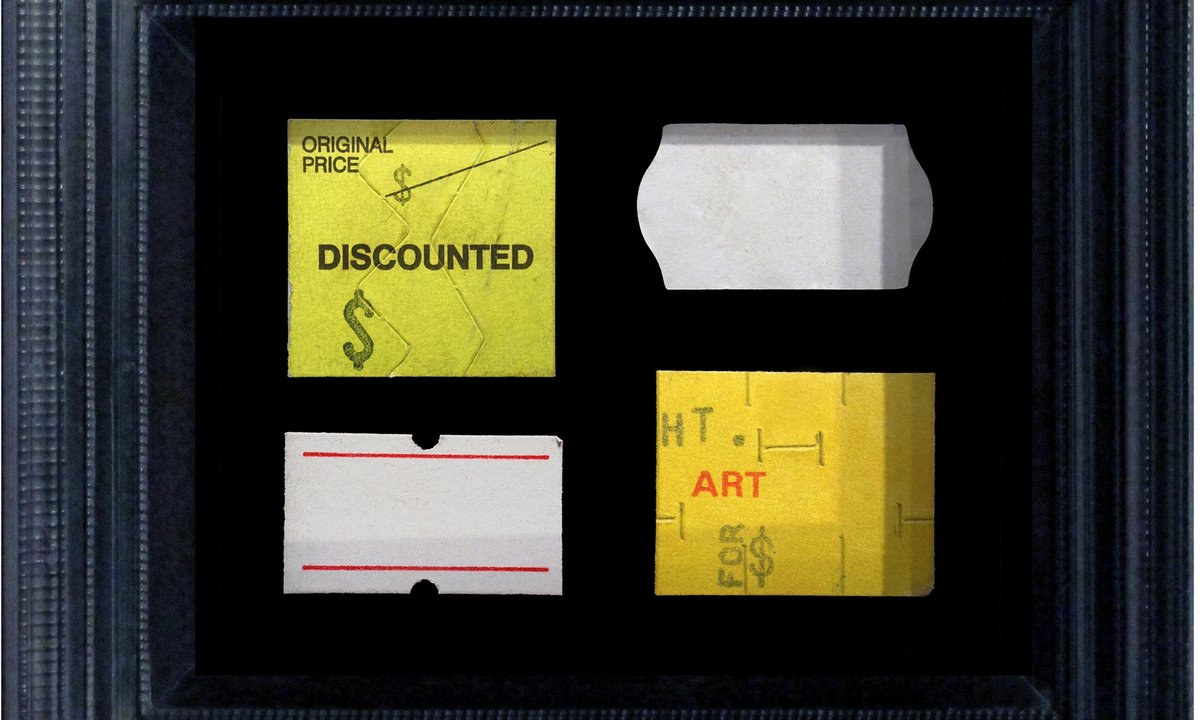

Art-market booms and busts reverse prevailing trends. In 2015 the Zombie Formalism market collapsed after a 7% contraction, prompting a shift toward figurative painting and a market recovery. A later inflection in 2022, driven by rising interest rates, cooled demand, made collectors cautious, and forced gallery downsizing while some buyers shifted toward Old Masters. Low interest rates had previously driven asset-price inflation and financialisation of collecting. Three consecutive years of contraction have put high prices under scrutiny as misaligned with long-term value and as barriers to new collectors. Dealers are quietly adopting more flexible pricing, with some advocating lower primary prices.

Read at The Art Newspaper - International art news and events

Unable to calculate read time

Collection

[

|

...

]